Finding ways to cut costs—and increase profits—is a priority for every roofing contractor. But doing so can be risky and challenging.

"If there's a new and improved product or piece of equipment that will allow us to work more efficiently, we're interested," says Mike Gasaway, general manager of Culver Roofing Inc., Gary, Ind. "But we have to be sure we're not sacrificing quality."

"You've got to be creative," adds Jerilee Mattingly, secretary/treasurer of Weatherguard Metal Construction Inc., Sierra Vista, Ariz. "To stay competitive, we're always trying not to raise prices. And we're always looking for ways to cut costs and save money."

During the past two decades, many businesses have adopted a new method of computing the cost of their products and services. The method is known as activity-based costing (ABC).

"Activity-based costing is the best cost-accounting system for producing accurate, relevant information for making decisions, including how to estimate the cost of jobs or projects," says Gary Siegel, an associate professor at Chicago-based DePaul University's School of Accountancy and Management Information Systems and a certified public accountant.

Siegel, who has worked with numerous professional associations to develop and implement ABC models for their industries, explains that the essence of ABC is the idea that businesses are "activity-driven." ABC determines the cost of these activities and shows how these activities affect the cost of a product or service.

Background

Between 1970-80, as manufacturing became increasingly automated, traditional cost accounting proved poorly suited to the task of providing reliable costing information. With direct labor shrinking to a small fraction of the production process and computer-related technology and other overhead increasing exponentially, the old formula that allocated overhead as a percentage of direct labor was producing a distorted cost picture. Easy-to-manufacture products often were costed too high and products that were difficult to produce often were assigned costs that were too low.

The problem became acute during the 1980s when the United States faced a crisis in manufacturing brought on by competition from Japanese and European firms. As U.S. companies lost market share, they scrambled to cut production costs, upgrade product quality and improve operations. "Re-engineering," "total quality management" and "continuous improvement" became the buzz words of the ensuing era as U.S. firms strove to regain their dominance. Meanwhile, a companion revolution took place in cost accounting. The result, ABC, gave companies an entirely new perspective on cost management.

"The benefit of ABC is knowing the cost of your activities or business processes. That's the key to controlling your costs and costing jobs more accurately," Siegel explains. "And by isolating business activities, ABC opens up the possibility of improvements in productivity and the ways firms operate."

Basics

To best understand the ABC concept, consider the following example. A firm's cost for any product or service is made of three components: direct material, direct labor and overhead. The first two are relatively easy to determine because they readily can be traced to a project via supplier invoices or employee time cards. But where job or project costing becomes less clear is with the third component, which takes in all the other expenses of doing business.

To make a profit, you need to have a reliable method of determining material, labor and overhead costs associated with a project so you then can add a profit margin and determine a project's selling price.

Specifically, when you price a residential or commercial roofing project, your experience generally gives you guidance so you can estimate the material and labor costs with reasonable accuracy. But how do you know how much indirect cost, or overhead, should be allocated to that job? How do you know how much will be required of top management and quality control or how much depreciation will take place on your equipment, for example?

The answer, according to Siegel, traditionally has been to come up with an overhead cost estimate per job based on the amount of labor cost per job. This method has been in use for the past century and is the most common approach to overhead allocation worldwide.

"Traditional accounting systems spread overhead costs to jobs in proportion to the amount of labor time or labor cost," Siegel says. "So a job with twice as much labor reflexively gets twice as much overhead."

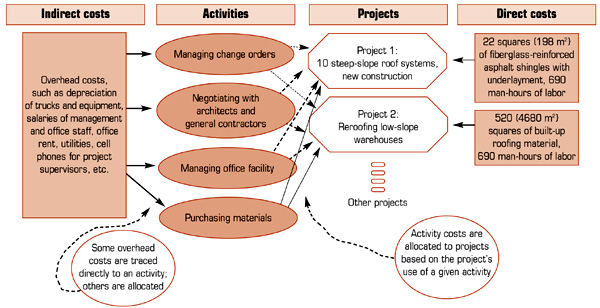

Siegel likens this arbitrary formula to "a peanut butter approach" because it spreads overhead costs equally to projects that have the same labor costs. It worked well in the days when most businesses were labor-intensive and overhead was a relatively small percentage of total production cost. Now, however, overhead is more complex; costs are higher; and there is much more variation in products and services. The net effect of these changes has wreaked havoc on traditional cost-accounting assumptions about how to handle overhead. As Figure 1 demonstrates, assuming projects with the same labor costs "consume" the same amount of company resources, such as management effort, depreciation and office-staff time, can lead to inaccurate cost estimates.

Figure 1: An example of a traditional costing system

The two projects shown in Figure 1 would be allocated the same dollar amount of overhead under traditional costing methods because they have the same amount of direct labor cost. Yet the new construction steep-slope project will require much more management time negotiating with architects and specifiers, many more change orders and more invoice handling on the large number of purchases of different materials. Under traditional costing, the disproportionate use of company resources to perform these extra tasks is not considered when allocating overhead.

Using ABC

ABC takes a formerly one-step cost allocation procedure and turns it into two steps.

Where traditional cost accounting assigns overhead costs such as rent and telephone to a firm's products or services, ABC takes those same expense categories and traces them to the activities, or processes, involved in running the business. Then, it determines how much of each process cost is "consumed" by each job or project.

In other words, expenses are assigned to activities, and activity costs are traced to "outputs."

Many activities—such as purchasing, billing and material handling, for instance—are common to all industries. Outputs, however, are unique to each industry. For roofing contractors, outputs may include residential roof system repair, commercial roof system replacement, new construction and a range of other services.

Siegel says making sense of process costs can be beneficial to roofing contractors in a variety of ways, such as pricing jobs, for example.

He explains: "Let's assume you've done your ABC homework and identified your activities, determined their costs and traced them to your outputs. Now, let's suppose you're bidding on two jobs, X and Y. Job X requires eight types of materials, and Job Y requires four types. In computing the cost of these jobs, Job X would be charged twice the amount of the ‘purchasing' process cost because twice as much purchasing process was required to obtain the material. Or let's say Job Y, though using fewer materials, uses materials that are more fragile and require greater care in handling. In this case, Job Y would be assigned commensurately more of the ‘material handling' process cost."

Figure 2: An example of an ABC model

In the example in Figure 2, if the warehouse reroofing project required fewer change orders and fewer contacts with suppliers, it would be assigned less overhead cost for those activities than the new construction project.

The value of this more accurate project cost information should not be underestimated. ABC can help identify the types of projects that erode company profits when the more accurate cost information is compared with the project's selling price. Furthermore, by identifying the costs of your activities, or processes, ABC can help you make better business decisions.

"Let's say you find out your telephone cost is 20 percent higher than a competitor's with comparable sales volume even after you've shopped for the best service package," Siegel says. "How do you bring down your telephone expense? Clearly, returning only 80 percent of your calls is not a viable option. Using ABC, you wouldn't solve the problem by focusing on the telephone bill, per se, but rather on the processes that are ‘driving' the telephone costs."

Among the processes you would scrutinize to reduce telephone cost are billing; bidding; maintaining facilities; managing the business (which includes dealing with accountants and lawyers and supervising employees); marketing; and keeping up to date on technology.

Siegel continues, "You may discover, for instance, that significant savings could be realized by outsourcing billing, finding faster ways to give job estimates or sourcing material more efficiently."

Moreover, the information produced by an ABC system would focus your attention on the activity or activities that cause the higher telephone bill rather than on the higher telephone bill itself.

Indeed, discussions about ABC in accounting textbooks and professional accounting journals highlight many examples of companies that used ABC data to save money by improving their processes and make better pricing decisions. For example, The Procter & Gamble Co., Cincinnati, used ABC to identify the cost of inefficiency in its ordering and invoicing. By streamlining the process, the firm realized millions of dollars in savings in traditional expense categories.

When Hewlett-Packard, Palo Alto, Calif., switched to ABC, accountants discovered the traditional costing system the company had been using reported high production costs for some products that were easily produced and low production costs for some products that were more difficult to manufacture. The result was distorted product costing for about half the products. An error of such magnitude seriously can affect product pricing and profit in any business.

"If you're pricing too high, you risk losing market share," Siegel says. "And if you're pricing too low, you might think you're making money on a job when you're actually losing money on it."

To reduce the cost of roofing projects, Siegel advises contractors to "see which processes are being consumed to get your jobs done. Then, reduce the cost of those processes."

The savings will show up as greater efficiency in your business processes and as a reduction in the cost of your products and services.

Processes and costs

If you are interested in implementing an ABC system at your company, first talk to your chief financial officers or accountant, who can either develop such a system in-house or with an outside consultant. Even small firms can realize benefits. A firm with $500,000 in revenue, for instance, might spend $20,000 to implement ABC because of the time spent by an accountant or consultant to determine the best way to capture the activity-cost information. But this expenditure easily could result in cost savings exceeding $20,000. And that's a saving that would be realized annually because the implemented ABC system will produce this information each year.

Another option, which has been implemented in the manufacturing and health-care industries, among others, is to have an industrywide ABC model developed by an ABC expert. Roofing contractors then could submit their traditional accounting data for analysis. Each would receive a report containing his company's process costs, as well as the unit costs of projects and services.

Having developed ABC models for eight surgical-specialty associations, Siegel says a standard model applies equally well to big and small firms, even if some firms do not perform every process.

Another major benefit of an industrywide model is the opportunity for benchmarking using comparative data, which is part and parcel of the trend in business toward continuous improvement. By participating in an industrywide database, a contractor can look up the process costs for firms with comparable sales volume. The reported information is aggregated and averaged. As a result, a contractor can't use the database to find out information about specific competitors and strict confidentiality is maintained.

In many industries, businesses have found benchmarking, or average cost information, for similar-sized firms is useful.

"Benchmarking gives you a yardstick," Siegel says. "It gives you a standard against which you can measure your firm's performance. If your costs are lower, you may or may not rest easy. But if your costs are higher, you know you have work to do."

Wrapping up

The best business decisions are made with the best cost data. If you are bidding for jobs based on cost estimates that allocate overhead based only on labor, your cost information probably is not meeting that standard.

By implementing an ABC system in your company, you could realize cost savings and improved performance. By developing an industrywide ABC model, roofing contractors could join the trend toward continuous improvement that has taken hold in other industries.

Gail Kaciuba is a certified public accountant and an associate professor of cost accounting at Midwestern State University, Wichita Falls, Texas. Beverly Siegel is communications director for The Gary Siegel Organization, Chicago.

COMMENTS

Be the first to comment. Please log in to leave a comment.