With the growth of large sprawling urban and suburban areas in hail-prone regions, the U.S. crossed the threshold of billion-dollar hailstorms during the early 1990s. As a result, manufacturers, insurers and testing laboratories have developed test methods to evaluate the impact resistances of roof coverings.

The first test method to gain widespread use was UL 2218, "Standard for Impact Resistance of Prepared Roof Covering Materials," which uses the impact of a steel ball falling from prescribed heights to establish performances of flexible roof coverings.

Although the UL 2218 test method has proved to be a good measuring stick for the relative hail resistances of flexible roof coverings such as asphalt shingles, the intense impact forces imparted by the steel ball usually are too great for rigid roofing materials, such as tile.

In response to this observation, in July 2005, FM 4473, "Specification Test Protocol for Impact Resistance Testing of Rigid Roofing Materials by Impacting with Freezer Ice Balls," which uses an ice ball shot from an air cannon, was modified. With the completion of that test standard, manufacturers now have two options for testing the impact resistances of roof coverings though it is expected UL 2218 primarily will be used for flexible roof coverings and FM 4473 primarily will be used for rigid roof coverings.

Both test methods test new roofing materials—not those that are aged and weathered. However, positive laboratory performance has resulted in positive field experience in real hail events, and there are potential benefits of using impact-resistant roofing products in high-risk hail areas. A study conducted after a storm in Texas illustrates some of these benefits.

Texas thunder

April 5, 2003, was a typical early spring day in the southern U.S. and numerous supercell thunderstorms formed throughout the area. One storm ultimately affected a swath of land several miles wide and nearly 200 miles long, tracking eastward directly over the northern suburbs of Dallas and Fort Worth, Texas. This thunderstorm produced heavy rain, lightning, an abundance of large hail, localized reports of straight-line wind gusts approaching 70 mph and even a few weak tornadoes. It was one of the costliest thunderstorms ever to hit Texas with an estimated total statewide insurance payment of $885 million, predominantly stemming from hail damage.

In the aftermath of the storm, the Institute for Business and Home Safety investigated insurance claims and losses resulting from the storm. Specific underwriting and claims data were collected from participating insurer members on 319,508 homeowner policies throughout the northern suburbs of Dallas and Fort Worth.

Analysis of the data collected produced a number of findings concerning the patterns of claims and insured losses resulting from a severe hailstorm. Several notable trends emerged from the study. For example, losses were observed that related to hail size, roof covering and impact-resistance status.

Among the most important conclusions was the finding that homes with roof coverings rated as impact resistant according to the Texas Department of Insurance (TDI) had a 40 percent lower claims rate. Considering only the homes with enough damage to result in a loss payment, homes with impact-resistant roofs actually suffered 55 percent lower losses (as measured by claims payments) than homes without impact-resistant roofs. (For the Texas study, roof coverings referred to as impact resistant are those for which TDI mandated premium discounts, which indicates the roof covering materials used were classified under the UL 2218 test standard.)

The available data on the 319,508 policies were made up of all homeowner insurance policies on single-family detached dwellings within an area surrounding and including the northern metropolitan areas of Dallas and Forth Worth.

Of these policies, 60,844 (19 percent) had claims resulting in insurance payments of $1 or more. Of all insurance policies investigated, 1,867 were for homes with impact-resistant roof coverings, nearly all of which were either asphalt shingle (56 percent) or metal (37 percent).

Of the homes with impact-resistant roof coverings, 162 (9 percent) had claims resulting in insurance payments of $1 or more. It is clear homes with impact-resistant roof coverings were significantly less likely to sustain damage than those without. More specifically, homeowners with impact-resistant roof coverings were 40 percent less likely to have filed claims.

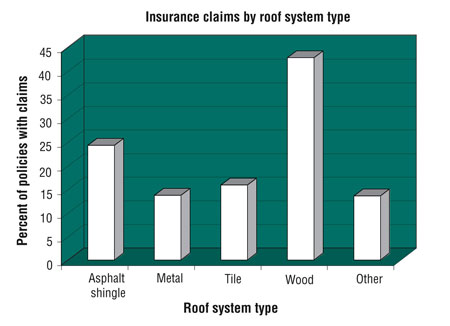

The percentage of policies resulting in claims also varied significantly with respect to roof system type. Figure 1 shows homes with wood roof coverings were the most likely to be damaged, with 43 percent of the policies resulting in claims. Twenty-four percent of homes with asphalt shingle roof systems had claims, and the other roof type categories experienced a claims rate of about 15 percent.

Figure 1: The percent of policies resulting in claims following a Texas thunderstorm varied significantly with respect to roof system type.

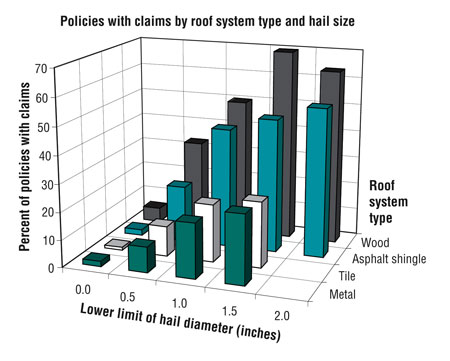

As would be expected, the claims rate also depended on hail size. Figure 2 illustrates the variation in claim rate for the various types of roofing materials as a function of hail size.

The overall reduction in number of claims on homes with impact-resistant roof coverings also might be affected by the average roof age of impact-resistant roof coverings versus nonimpact-resistant roof coverings. This primarily is because TDI started a program in 1998 that provides incentives for homeowners who install impact-resistant roofing materials, resulting in a significant increase in the number of impact-resistant roof coverings.

Figure 2: The larger the hail size, the more likely it was for a claim to be filed.

Therefore, the average age of roofs covered with such materials most likely is less than that of roofs covered with nonimpact-resistant materials.

Based on the study results, it can be concluded the relative field performances of various roof coverings when subjected to hail directly correlate with their abilities to pass test standards for impact resistance.

For impact-resistant asphalt shingle roofs, the decrease in the percentage of homes with claims resulting in insurance payments varied between 40 percent and 60 percent depending on the size of hail to which the roofs were subjected. For homes with impact-resistant metal roofs, the decrease was between 60 percent and 80 percent.

Benefits

There are numerous benefits for homeowners who install impact-resistant roofing products on their homes. For example, most insurers offer substantial discounts in high-risk hail areas. Also, as the frequency of damage is reduced, a homeowner most likely will have fewer deductibles to pay. This may prompt homeowners to select higher deductibles, which may save even more on their premiums. As a result, the payback on the additional costs of installing an impact-resistant roof in a high-risk hail area can be as soon as three years to four years.

In addition, the discount a homeowner receives for having an impact-resistant roof system may be transferable if the property is sold.

You can benefit from installing impact-resistant roofing materials, as well. If you install products that can withstand damage, you may enjoy repeat sales and customer references.

Bottom line

By educating your homeowner clients about the benefits of impact-resistant roof coverings, you can help them save money on insurance—as well as save them headaches that can result from repairing damage caused by severe weather.

Michael Milligan is a roofing specialist in the Loss Mitigation Unit of State Farm Fire and Casualty Co., Bloomington, Ill.; Timothy A. Reinhold, Ph.D., is director of engineering and vice president for Institute for Business & Home Safety; and Jason V. Smart is a senior evaluation specialist with International Code Council Evaluation Services.

COMMENTS

Be the first to comment. Please log in to leave a comment.