Every day, another report proves retirement and savings accounts are not priorities for many people. In fact, roofing contractors often are unaware of the missing elements—discipline, sacrifice, consistent planning—in their retirement and savings programs because they think the future sales of their businesses will be enough to satisfy their retirement needs. But planning for the future involves much more than most people realize. Following are some tips to consider when selecting a retirement plan, particularly if you have a small or new roofing company.

Using skills

Currently, roofing contractors typically fall into two categories: those who come from family-owned businesses and those who work their way up through the ranks to start their own businesses. Family-owned businesses usually are larger with $10 million or more in annual sales and 100 or more employees. They also are more sophisticated in their approach to financial management and retirement planning for their companies. Some of this may be because younger family members who have been raised in the roofing business often have more formal education and contribute their knowledge to the family enterprise. Equipped with business or law degrees, these family members recognize the need to develop a business plan that addresses organizational structure, marketing, financing, historical analysis and financial projections.

On the other hand, smaller firms (those with annual sales of less than $10 million and 10 to 20 employees) appear to most need financial counseling and business-management skills. Because most roofing workers acquire their skills informally by working for more experienced roofing contractors, it can take several years before roofing workers reach the point of starting their own businesses. With the bulk of energy and time initially spent learning the trade, a new business owner's focus immediately must shift to obtaining work to pay crew members and support a family. This time period is the low entry point for money; with virtually no support from banks, many roofing contractors are forced to draw on home equity loans or use credit cards to buy supplies and equipment. But business-management skills usually are acquired by trial and error; the rule becomes "learn from mistakes, and try not to make them again."

Roofing contractors who are just starting out need to realize early during their business careers there are competing demands for the money they earn. How do they save for retirement, grow a business, begin an investment program and take care of a family? Although it is not easy, it is not impossible. But it is important to recognize common mistakes.

Following are some of the most common money-management slip-ups:

An example

Consider a hypothetical financial profile of a young roofing contractor. He worked his way up through the ranks, became a foreman and decided to start his own business. Growing the roofing side of the business was not a problem but managing the business was. After struggling for a few years, he transitioned into a more mature business owner.

Assume the owner is a 32-year-old married male who earns $55,000 per year before taxes and has a 2-year-old child. His wife works part time, earns $15,000 per year and is pregnant with their second child. They are in the 35 percent tax bracket with an after-tax annual income of $45,500 and after-tax monthly income of $3,792.

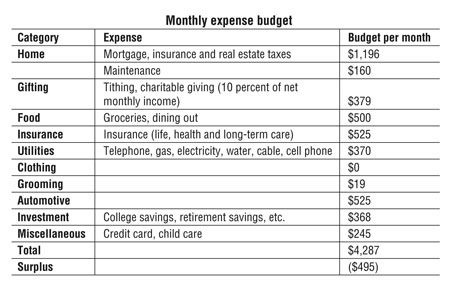

Figure 1: The budget of a 32-year-old roofing contractor who is married and has a child. His salary is $55,000 per year and his wife works part time, earning a salary of $15,000 per year. His after-tax monthly income is $3,792.

Initially, the couple make a commitment to pay themselves first. The two set aside 10 percent of their net monthly income for taxable savings and tax-deferred retirement plans; another 10 percent goes toward tithing and charitable giving. They are not excessive in their spending though their credit card debt, on which they make only minimum payments, continues to increase. The monthly budget in Figure 1 is an ambitious start for them, but it is a little unrealistic to maintain.

After a year or so, they soon find their expenses outweigh their cash flow. As a result, they fall into the snare that many people fall into—they use credit cards and cash advances to pay their expenses, resulting in even more debt. A quick look at the monthly budget reveals a deficit of almost $500 per month. How should they handle this?

With regard to the credit cards, making only the minimum $125 payment on a $4,000 debt will take almost 11 years to erase, and the total interest paid, in addition to the original debt, will be $1,836! If the goal is to pay off the debt in two years, payments would need to be increased to $188 per month, and the total interest paid would amount to $514. By eliminating this debt, the contractor can pave the way for other adjustments to be made. He makes a goal to rid himself of this debt nightmare in two years. He knows he can succeed because of his determination and work ethic. However, to reach this goal, temporary adjustments have to be made for a few years and priorities realigned. Where do those adjustments take place?

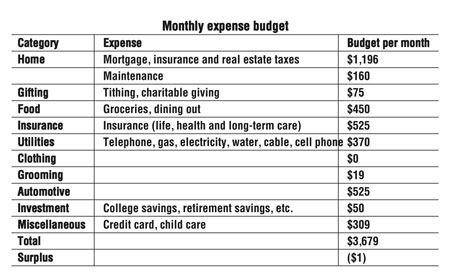

Wisely, the contractor and his wife force themselves to contribute 3 percent to their respective 401(k) plans. Taking this initial important step helps them decrease their gross taxable income and, subsequently, their marginal rate of taxation. Their retirement savings grow tax-deferred because no taxes are due until money is pulled out of the accounts. Charitable contributions and personal savings dramatically are reduced for a period of two years—again, the primary goal is to reduce the credit card debt. They agree to cut back slightly on dining out and entertaining. They purchased used cars before the children were born and, to avoid car payments, continue to maintain them for their transportation needs. The budget in Figure 2 shows how problem areas are addressed and priorities assigned.

Figure 2: The revised budget of a 32-year-old roofing contractor who is married and has a child. His salary is $55,000 per year and his wife works part time, earning a salary of $15,000 per year. He contributes $2,100 annually to his 401(k). His after-tax monthly income is $3,678.

By the time the roofing contractor reaches his 38th birthday, he will reach a number of milestones.

First, his perspective will change. The ability to differentiate between wants and needs will enable him to leave his debt behind. Small monthly contributions to retirement plans and a slow payment plan on credit cards will pay off.

His business philosophy will change, as well, thanks to time well-spent in some night-school business classes. For example, he may discontinue hiring subcontractors on a piece-rate system. The use of this pay system resulted in no loyalty to the company, constant complaining and lack of unity.

The quality of this contractor's work will become more important to him, and a good reputation in the business community will be crucial, especially with his suppliers. As his business and knowledge base grow, he gradually will transition to an hourly pay system. This move will enable him to replace and train workers according to his standards. Good employees, he will realize, are no different from him; they want to feel like part of a company and are looking for security.

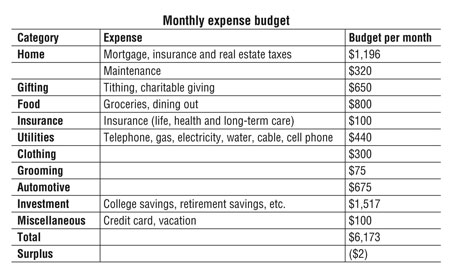

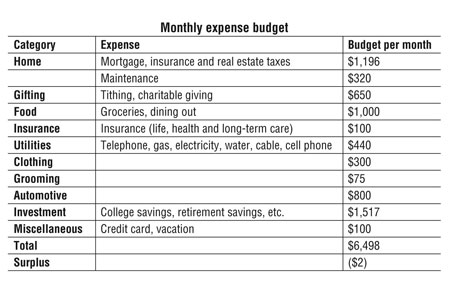

By the time the roofing contractor reaches age 45 and is in the expansion phase of his business, he finally will "get it." Slowly increasing the contributions he and his wife make to their retirement plans will prove not to be a hardship. In fact, the side-by-side comparison in Figure 3 and Figure 4 with a "what-if-I-had-not-saved-for-retirement" budget shows that most of the differences in allocation would have gone toward food or automobiles.

Figure 3: The budget of a 45-year-old roofing contractor who is married and has two children. His salary is $120,000 per year, and he contributes $6,000 annually to his 401(k). His after-tax monthly income is $6,175.

Figure 4: The budget of a 45-year-old roofing contractor who is married and has two children. His salary is $120,000 per year, and he has not contributed to his 401(k). His after-tax monthly income is $6,500.

Reaping the benefits

Planning for the future can be a difficult and stressful experience that takes time and careful spending. But for many roofing contractors, the desire to protect their futures already is in place. In the end, it is a matter of strategic planning. With the right materials and counsel, contractors who devote time and effort to financial planning can reap rewards from those efforts.

Dawn J. Bennett is founder and chief executive officer of Washington, D.C.-based Bennett Group Financial Services, a provider of wealth-management services.

COMMENTS

Be the first to comment. Please log in to leave a comment.