In Henry V, Shakespeare wrote about "the singing masons building roofs of gold." Although this assessment of roofing may oversimplify the current complex reality, contractors responding to The National Roofing Contractors Association's 2002-2003 Annual Market Survey revealed an overall confidence that bodes well for 2003. The information respondents supplied may not tell you how to turn roofs into gold, but it can help decision making become a less anxiety-laden proposition.

The Gary Siegel Organization, a Chicago-based independent opinion research firm, conducted the study and aggregated individual, confidential responses into a finely detailed picture of the current roofing industry. As in previous years, survey questions addressed a wide range of issues related to low-slope (commercial) and steep-slope (residential) sales, equipment purchases and material preferences, among other topics.

"It's a difficult survey to which to respond," says Gary Siegel, president of The Gary Siegel Organization, who has overseen the research for the past four years. "We're not just asking for opinions. People have to take the time to pull out their files."

Questionnaires were sent to 2,043 NRCA members and 2,058 nonmembers, yielding a response rate of 16 percent among the former and 6 percent among the latter. Of the 4,101 contractors surveyed, about 11 percent—447—responded, which is slightly better than the previous year's survey. The consistency of the responserate means the data offer reliable reflections of industry trends. However, because respondents did not answer every question posed, the number of responses varies for each question. Also, some figures were rounded, so the results in each category may not equal 100 percent. As a result of these issues, the survey is not a definitive representation of the entire roofing industry.

Nevertheless, you may be interested in the breakdowns of material purchases by sales volume, region and a host of other factors and can use the information to make several important business decisions with greater certainty.

"Whether planning budgets, labor expenditures or equipment purchases for the coming year, understanding the trends [reflected in the survey] makes planning easier—and less risky—for business owners," Siegel says.

Sales and forecasts

Survey respondents' reported annual sales volumes clustered slightly more heavily in the upper sales volume brackets: In 2002, 28 percent reported sales of $1.7 million to $3.9 million, and 25 percent reported sales of $4 million or more, up from 26 percent and 21 percent, respectively, in 2001. However, average annual sales volume among respondents virtually is the same as in the preceding year—slightly more than $3 million. Contractors' sales volume projections for 2003 generally were optimistic—42 percent of respondents expect higher sales volumes this year; 42 percent expect comparable sales volumes; and 16 percent anticipate declines.

Regional variation prominently figures in the survey with contractors in the Pacific and Mountain regions most sanguine—more than half the respondents in both areas expect higher sales volumes this year.

Jerilee Mattingly, secretary/treasurer of Weatherguard Metal Construction Inc., Sierra Vista, Ariz., which is near the Mexican border, credits the influx of retirees and related service industries for fueling an upsurge in her residential and commercial roofing business.

"The area is growing like crazy," she says. "Development-wise, we're where Tucson was 15 years or 20 years ago."

David Montross, president of Montross Weatherproofing Systems Inc., San Clemente, Calif., logged a substantial increase in sales during 2002, which, he points out, was more remarkable because of the absence of rain. He bases an optimistic forecast for 2003 on an upscale market and clients who understand quality.

With a service mix that comprises commercial properties, apartment buildings and homeowner associations, he says: "The groups I service have to allocate for repairs. Property values here are increasing dramatically, and people have been educated to appreciate the value of good maintenance."

Contractors in the West South Central states tendered the most conservative sales projections with only 34.1 percent expecting higher sales volumes and 29.3 percent expecting reduced sales volumes in 2003.

"I think business will improve after the first quarter," says Bill Waite, president of William V. Waite Roofing Co., Hot Springs, Ark., who confirmed that many people in his service area have been reluctant to undertake capital improvements.

Mark Richards, president of Arrowhead Roofing, Tulsa, Okla., cites a spate of insurance work to repair storm damage from recent hailstorms and tornadoes as the cause for lower sales projections this year.

"We put new roofs on houses that were three or four years old," he says. "A lot of work that would have occurred down the road as typical, life-cycle repair came up early as replacement."

Richards adds that weather forecasts of increased storm activity throughout Oklahoma and Kansas have made travel an increasingly important aspect of his business as he widens his area of operations in pursuit of increased sales to owners of storm-damaged properties.

Meanwhile, the lingering effects of the stock market downturn, corporate downsizing, and a variety of other regional and market factors create a challenging business environment for some roofing contractors.

Bill Diamond, president of Diamond Inc., Waterbury, Conn., an open-shop company, often competes for large-scale bid work that calls for prevailing wage. Resulting higher labor costs combined with the slow economy curbed his projections for 2003.

Looking ahead to better times, he says, "Some people use unprofessional roofing contractors, but eventually, the professionals get the business."

The slant on slope

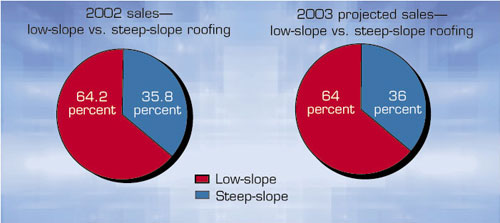

For the fourth consecutive year, the survey revealed a near-steady ratio of low- to steep-slope sales: 64.2 percent to 35.8 percent, respectively, as shown in Figure 1. (For survey purposes, low-slope roofing refers to roof slopes of 3-in-12 [14 degrees] or less.)

Figure 1: Low- and steep-slope roofing sales

"The ratio is a result of the way buildings are built. You won't see steep-slope roof systems on factories, industrial parks or apartment buildings," says Jaye Schwartz, vice president of Avondale Roofing, Niles, Ill. She notes that 70 percent of her work on single-family homes is steep-slope with the remaining low-slope portion devoted to dormers, porches and garages.

Respondents in the Pacific region report the highest percentage of steep-slope roofing work in relation to total roofing sales, registering 50.4 percent.

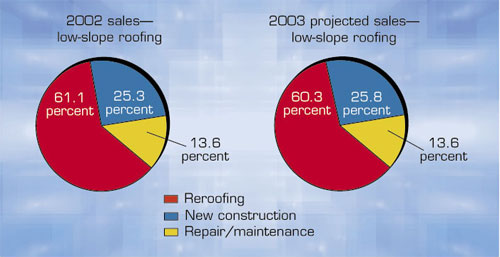

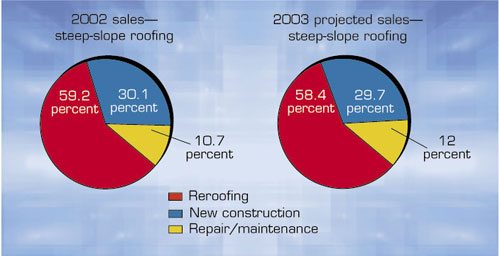

Within low-slope roofing, the ratio of new construction to reroofing to repair/maintenance is virtually the same as it was in 2001 at 25.3 percent, 61.1 percent and 13.6 percent, respectively (see Figure 2). For steep-slope roofing, as well, the ratio of new construction to reroofing to repair/maintenance is holding steady at 30.1 percent, 59.2 percent and 10.7 percent, respectively (see Figure 3).

Figure 2: Reroofing, new construction and repair/maintenance sales for low-slope roofing

Figure 3: Reroofing, new construction and repair/maintenance sales for steep-slope roofing

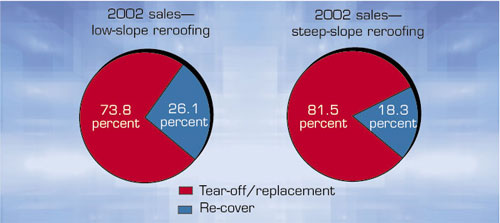

Interestingly, both within low- and steep-slope reroofing, tear-off/replacement has increased relative to re-cover projects (see Figure 4). From 1998-2002, tear-off/replacement steadily has increased from 61 percent of low-slope reroofing sales to 73.8 percent. During that same period, tear-off/replacement has increased from 77 percent of steep-slope reroofing to 81.5 percent.

Figure 4: Reroofing methods used for low- and steep-slope roofing

Brett Shelton, president of Brett Shelton Roofing Inc., Santa Cruz, Calif., views the change as a positive sign.

"I know I'm giving a consumer a better roof system when I can expose and address termite or dry-rot damage," Shelton says. "That can't be done if I don't tear off [a roof system]."

South Atlantic and Pacific regions are highest in tear-off/replacement as a percentage of low-slope reroofing sales coming in at 78.1 percent and 84.1 percent, respectively. Alaska and Hawaii, Mountain and East South Central regions show the lowest percentages of tear-off/replacement relative to low-slope reroofing with 60.3 percent, 64.4 percent and 63.1 percent, respectively.

For steep-slope reroofing, Pacific and South Atlantic regions claim the highest percentages of tear-off/replacement relative to total reroofing sales at 85.2 percent and 86.9 percent, respectively.

Materials and Insulation

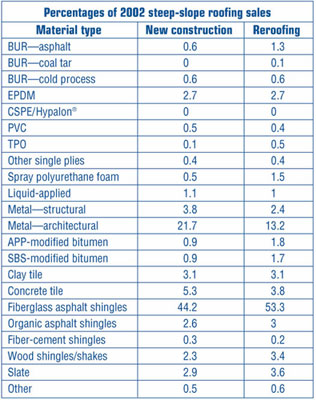

As shown in Figure 5, fiberglass asphalt shingles once again dominate the steep-slope material market, accounting for 44.2 percent of sales for new construction and 53.3 percent for reroofing.

Figure 5: Average percentages of 2002 steep-slope roofing sales by material type

"The bottom line for most contractors is that fiberglass asphalt shingles go down quickly and wear well in different temperature conditions," says Matt Millen, secretary/treasurer of Millen Roofing Corp., Milwaukee. "And you can buy them easily at a good price."

Regional differences are apparent, however, with fiberglass asphalt shingles used in 60.3 percent of new construction steep-slope roofing in East North Central states and 27.1 percent in West South Central states. Architectural metal, which accounts for 21.7 percent of new construction steep-slope roofing sales nationwide, garners 43.7 percent in the West South Central region and only 8.6 percent in New England.

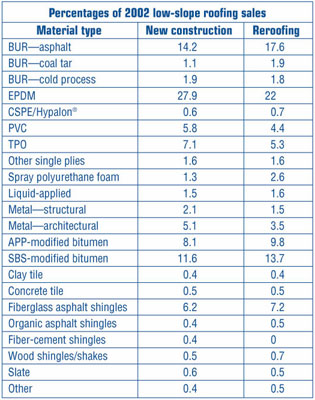

For low-slope roofing, EPDM is once again the material to beat, claiming 27.9 percent of new construction sales and 22 percent of reroofing sales (see Figure 6). The next favorite, SBS-modified bitumen, garners 11.6 percent and 13.7 percent market shares, respectively.

Figure 6: Average percentages of 2002 low-slope roofing sales by material type

EPDM especially is popular in New England (scoring 50.2 percent of new construction sales) where temperature fluctuations often cause stress to roof systems.

With the greater elasticity provided by EPDM, a roof can expand and contract without splitting, says William Seppalla, president of Prime Roofing Corp., New Ipswich, N.H.

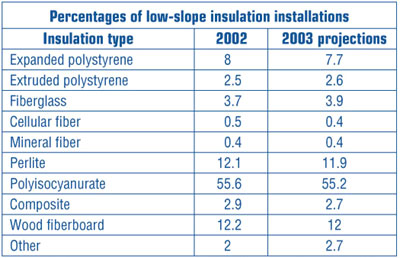

In 2002, as in the year before, polyisocyanurate was the most popular choice for low-slope insulation, boasting 55.6 percent of the market and clear dominance in all regions (see Figure 7). Running a distant second among low-slope insulation materials, wood fiberboard (12.2 percent) edged out perlite (12.1 percent).

Figure 7: Average percentages of 2002 and projected 2003 low-slope insulation installations by insulation type

Decisions, decisions

Similar to previous years, architects and specifiers were most likely to influence the decision of which roof system to use for new construction, but some regional variations are evident.

In East South Central and Mountain regions, architects and specifiers influenced the decision 95.7 percent and 92.3 percent of the time, respectively, and roofing contractors in those regions exerted an influence in 44 percent and 65 percent of the situations, respectively. (Decision making often is a collaborative affair; respondents were asked to indicate all groups who have input in a decision rather than choose only one.) In Pacific and South Atlantic regions, architects and specifiers were considered to have input 73.2 percent and 77.5 percent of the time and roofing contractors were involved 54 percent and 55 percent of the time, respectively.

For reroofing projects, contractors decided the type of system by a margin of 81 percent followed by architects and specifiers, who were involved with 50 percent of decisions.

For new construction projects, roofing contractors chose the material manufacturer for 72 percent of the projects and architects and specifiers were involved in 64 percent of the selections. As for factors affecting the decision of which material to use, contractors gave the following order of importance: track record, manufacturer service, price, ease of installation, availability and warranty. Track record and manufacturer service retained their first- and second-tier positions from the previous year's survey, but—suppliers, take note—price moved into third position, ahead of ease and availability, up from fifth place.

Serving the industry

Although this article presents an overview of the data contained in the survey, a complete reading of the figures, with breakdowns by sales volume, number of employees, years in the business and more can yield many interesting and valuable insights.

Editor's note: NRCA's 2002-03 market survey will be available this spring exclusively on CD-ROM. To purchase the market survey, contact NRCA InfoExpress at (866) ASK-NRCA (275-6722) or access shop.nrca.net.

Beverly Siegel is communications director for The Gary Siegel Organization, Chicago.

COMMENTS

Be the first to comment. Please log in to leave a comment.