For nearly 100 years, states have based their taxes on federal taxes, most notably those addressing estate tax and depreciation. But when the federal government decides to reduce—or eradicate—certain taxes, states face significant losses in revenue. To recoup their losses, some states vote to "decouple" themselves from certain federal taxes and write their own tax codes.

Of course, that just makes filing taxes more complicated for you.

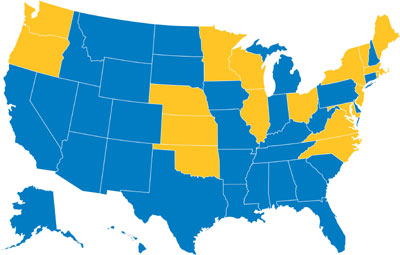

After President Bush's bill to repeal the estate tax passed Congress, 18 states passed legislation to decouple their estate tax laws from the federal tax law. (The 18 states are highlighted in the map.) In addition, the federal government's push to change how businesses depreciate equipment, for example, is not widely accepted by state tax bodies. (The biggest hurdle for states to overcome is what is known as "bonus" depreciation, which allows businesses to write off up to 50 percent of an asset during the first year rather than depreciating the full amount during the useful life of the asset.)

The 18 states that have "decoupled" from the federal estate tax are shown in yellow.

So what does that mean for you? Basically, higheraccountant fees if you conduct business in any of the 18 states that have decoupled from the federal law.

Regarding the estate tax, you and your accountant will need to figure out how your state exclusion (the amount you can bequeath tax-free) differs from the federal exclusion ($1.5 million this year and set to disappear in 2010).

And for depreciation: You will have to track the depreciation of equipment differently for federal and state tax purposes. The fun multiplies if you conduct business in several states with different depreciation tax laws. Because the depreciation schedules potentially could vary widely, your reported gains and/or losses will vary, as well.

For links to articles about state and federal tax issues, log on to www.professionalroofing.net.

Ambika Puniani Bailey is editor of Professional Roofing magazine and NRCA's director of communications.

COMMENTS

Be the first to comment. Please log in to leave a comment.