One requirement of accepting the designation roofing professional is that you continually must educate yourself. Your clients trust you to have expertise and depend on you for it. And homeowners and building owners consider your product knowledge when they compare your services with competitors.

Therefore, it is your responsibility as a professional roofing contractor to be aware of what is available in the marketplace and the potential performances of future products. For example, a new generation of asphalt shingles is developing. These shingles are built to be more durable, which means they are more loss-resistant, and the insurance industry supports their use for various reasons. Arming yourself with knowledge about these shingles can benefit you and your clients.

Improving shingles

As a nation, the United States averages 3,000 hailstorms per year that threaten all but a handful of states.

Bloomington, Ill.-based State Farm Insurance® Cos.' fifth-largest payout for a single catastrophic event was in 1995 when a hailstorm pummeled Fort Worth, Texas, for 20 minutes—claims totaled nearly $245 million. In comparison, the company's total wind/hail losses resulting from numerous storms during 2001 were about $600 million. For property insurance to remain competitive and affordable, State Farm Insurance is supporting the development and promotion of more loss-resistant roofing materials.

Photo courtesy of Ed Cochron, an independent sales representative from Cheyenne, Wyo.

Damage such as this can be common following a hailstorm. State Farm Insurance's fifth-largest payout for a single catastrophic event was in 1995—a hailstorm caused claims totaling nearly $245 million.

Asphalt shingles remain the most affordable steep-slope roof covering choice available. Until recently, you probably haven't had much variation to offer customers. For years, your steep-slope covering recommendations had to be based on a shingle's product style, weight, color, warranty and manufacturer's name.

Recommendations based on such criteria would be fine if any of the recommended products could be expected to survive their suggested life spans in high-risk areas or it simply was impossible to build better shingles. Unfortunately, the asphalt shingles to which you formerly were limited rarely live up to their anticipated life spans in hail-prone areas.

Interestingly, during the past 30 years, manufacturers of low-slope roofing materials have offered a much better choice of roof systems to consumers than steep-slope roofing manufacturers.

Professional specifiers of low-slope roof systems are able to sift through a variety of product options and make recommendations based on building design and use, as well as weather conditions a roof system will have to endure.

The need for a variety of product performance levels in the steep-slope roofing market is much the same as in the low-slope roofing market. A variety of demands is placed on shingles exposed to the different conditions in U.S. regions. There are extreme conditions in coastal and flat-line wind areas; the Hail Belt, where baseball-sized hailstorms occur weekly in some locations; and desert climates that experience relentless ultraviolet-light exposure. Weather events in these areas are most likely to reduce asphalt shingles' expected life spans and increase insurance claims.

Photo courtesy of Ed Cochron, an independent sales representative from Cheyenne, Wyo.

Baseball-sized hail was produced during a hailstorm in Scottsbluff, Neb., in 2001.

Simply put, the cost of insurance reflects the cost of claims. When the cost of claims drives the cost of coverage to levels that become too much of a burden, loss prevention offers the best long-term solution.

Setting the standard

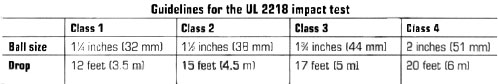

In 1996, State Farm Insurance worked with the Institute for Business and Home Safety and Underwriters Laboratories (UL) Inc. to develop a test standard to grade roofing materials' impact resistances. The test, UL 2218, "Impact Resistance of Prepared Roof Covering Materials," grades four levels of impact resistance—Class 1 (the least resistant) through Class 4 (the most resistant).

Guidelines used when testing shingles according to UL 2218.

UL 2218 is a falling-missile test using steel balls. Roofing materials must survive a double hit in the same spot without being damaged to be considered impact-resistant. (See the figure for UL 2218's guidelines.)

The fact that this test was used to simulate a shingle's performance against hail was not received well by many manufacturers—especially those without products that could survive the Class 4 test. Their major concern was (and, in most cases, still is) that a steel ball does not simulate hail. Also, testing is done with new products under laboratory conditions. The obvious questions being asked are: Will these products continue to perform at the same levels of impact resistance as they age, and what effect will various weather conditions have on the products' impact resistances?

These are valid observations. But I think manufacturers are missing the point. What really is important is that a viable benchmark has been established that can be used to predict a product's probable performance against impact. Products meeting UL's Class 4 standard resist hail damage far better than asphalt shingles not meeting the standard.

And as a result of the testing guidelines, the Texas Insurance Commissioner ordered insurers conducting business in that state to give Texas homeowners premium discounts of up to 35 percent for impact-resistant roof coverings when they meet UL qualifications. That was in January 1998, and since then, the success of these products has encouraged premium discounts to be voluntarily offered by some insurance companies in 22 states and Alberta, Canada.

State Farm Insurance's experiences with Class 4 products have been extremely positive. Time and again, such products have survived impacts from 2-inch (51-mm) and larger hailstones that have destroyed nonclassified roof systems near them. State Farm Insurance knows this because it has more than 13,000 policyholders with impact-resistant roof systems on their homes and has been tracking those products' performances for about five years.

The technology is there

Most major roofing manufacturers not only have the capability to produce shingles with improved impact resistances, but most already have prototypes ready for production. Unfortunately, not all manufacturers have chosen to be proactive with impact-resistant products. The most common reason given is that there is no market for these products. This is an interesting challenge. It is difficult to create a market without a product, and manufacturers are slow to produce a product without a market.

The market demand for impact-resistant products has been growing gradually, but it takes an enormous educational effort to create product awareness. There has been little or no effort by most roofing manufacturers to educate homeowners, contractors and distributors about products that could survive severe weather common in certain areas.

Manufacturers have pointed out some concerns with the widespread use of impact-resistant shingles. For example, the insurance industry has urged that such products be labeled, but many manufacturers claim labeling will be a hardship and too expensive.

But insurance companies agree to replace products of "like kind." Labels help insurers do that. If a shingle is labeled, an insurance company can confirm whether a damaged roof system was impact-resistant so it can be replaced with the same material. State Farm Insurance recently replaced more than 70 impact-resistant roof systems that were damaged as the result of a hailstorm that was so intense and long that hail not only penetrated the shingles and underlayment but also the sheathing. Labels helped ensure these homeowners received new impact-resistant roofing materials.

In addition, some jurisdictions require shingle labeling. For example, to comply with the Texas Department of Insurance's requirements, impact-resistant shingles must be labeled with the product name, manufacturer's name, the fact that it was tested against the required standard and the year it was manufactured. These requirements are not much different from product requirements in Dade County, Fla. Manufacturers producing labeled products don't find this to be a significant issue.

Wind and hail

There is a liability question with regard to product labeling. What if a Class 4 shingle is damaged by hail the size of the steel ball used to qualify a Class 3 product? The concern I heard from one manufacturer was that it would be liable instead of the insurance company if its name was found on a damaged shingle. Let me emphasize there is no correlation between a steel ball and hail. Shingles are not (or at least should not be) sold or promoted as hail-resistant—they are impact-resistant. Unless a manufacturer issues a warranty against hail damage, liability exposure for damage caused by hail is negligible.

Wind damage to shingles has been a concern, as well. Fortunately, the maximum wind speed asphalt products are able to resist significantly has increased recently. The industry has seen shingles go from a high-wind-speed resistance of 60 mph (27 m/s) to 90 mph (40 m/s), and 110-mph (49-m/s) resistance has become more common. One manufacturer has a product on the market advertised to resist wind speeds up to 130 mph (58 m/s). That is a wind load equal to a Class 3 hurricane. Of course, a manufacturer may take on more liability depending on its warranty language.

These major advancements have been made in a relatively short amount of time. I believe manufacturers have the technology necessary to produce shingles that can resist 130-mph (58-m/s) winds if they so choose. A higher wind-resistance capability will become more commonplace in high-end loss-resistant products in the near future.

Photo courtesy of Ed Cochron, an independent sales representative from Cheyenne, Wyo.

Impact-resistant products in Scottsbluff, Neb., outperformed State Farm Insurance's expectations.

Labels also enable State Farm Insurance to issue discounts when applicable if a customer buys a house with an already existing impact-resistant roof system. Currently, State Farm Insurance recognizes the following products made by their stated manufacturers as products its policyholders can use to become eligible for premium discounts in participating states: Portland, Ore.-based Malarkey's Alaskan, Hurricane and Legacy shingles; Chicago-based IKO's Dynasty shingles; Atlanta, Ga.-based Atlas' Stormaster shingles; and Pasiano, Italy-based Italian Membrane's Tegola Italiana Classic and Tegola Italiana Classic 4 F/V shingles.

There also are a growing number of specialty shingles available. Polyurethane, plastic, rubber and metal products are being offered in styles that simulate tile, slate, wood shakes and asphalt shingles. Most of these products are highly wind-resistant, as well as impact-resistant.

State Farm Insurance lists more than 450 products on its Web site, www.statefarm.com, that make customers eligible for premium discounts if they have one of those products covering their houses. The list constantly changes, and State Farm Insurance updates it monthly.

Who benefits?

Homeowners obviously will benefit from improved shingle products. Improved shingle products are more likely to withstand adverse weather conditions, which will reduce the likelihood of a homeowner being faced with the inconvenience of roof system replacement and expense of paying a deductible.

But currently, it is too difficult for consumers to understand the performance levels of roofing materials they buy. It would be beneficial for consumers if a new rating system could be developed to make their purchases easier. Such a system could be designed to categorize a shingle's expected performance level so a homeowner could decide which shingle to choose for his geographic location.

For instance, a shingle might have a Class 4 impact-resistance rating, be wind-resistant up to 110 mph (49 m/s) and have a Class A fire rating. Once a consumer knows the category level appropriate for his location, he could choose from various brands and styles of appropriate shingles.

Keep in mind that your credibility as a roofing professional is strengthened when the roof system you recommended and installed still is intact following damaging wind or hail events. This especially is true when lesser quality roof systems are destroyed in the same area.

The bottom line

It is State Farm Insurance's policy not to recommend specific brand-name products. But it does recommend concepts, such as impact resistance, wind resistance and fire resistance. Insurance companies share the advantages of using products that resist such elements with policyholders, and policyholders are being asked to consider these products when making roofing decisions. State Farm Insurance also recommends homeowners discuss products with roofing contractors before they make final decisions. State Farm Insurance's experience has been that once an expert, such as a roofing contractor, informs homeowners about these products, they generally make the right choices for their homes and locations.

Ron Bacon is a loss-prevention administrator for State Farm Insurance Cos., Bloomington, Ill.