Although significant strides have been made to improve roof system performance during the past decades, the roofing industry continues to cling to a limited definition of quality. At a time when many industries are viewing quality in broad terms of customer satisfaction, the roofing industry (as well as the entire construction industry) continues to cling to a more narrow definition of quality as "conformance to requirements."

Conformance to requirements defines quality as satisfying a set of specifications rather than satisfying a customer. The definition assumes specifications will meet customer needs and wants, but some quality experts disagree.

In their article, "An assessment model for quality performance control in residential construction," published in the Journal of Construction Education, Robert C. Stroh and Zeljko M. Torbica state: "Conformance to requirements ... assumes that we can get stable and complete requirements; it ignores the potential mismatch between what is specified and what the customer needs or wants. In fact, customers may not know or care how well a constructed facility conforms to specifications; they simply want their needs and expectations to be met."

At a research level, little work has been conducted in the construction industry to explore these human and social dimensions of quality, especially those factors involving the cooperation of different participants in the construction process. To expand the industry's understanding of quality, the research I present seeks to view roofing quality as a broader social process rather than the narrow conformance to specific technical criteria.

Key quality factors

In spring 2001, I conducted telephone interviews with 20 recognized authorities in the commercial roofing industry representing all industry segments. These experts were asked to identify and describe activities they consider most important to achieving quality and customer satisfaction.

Based on these interviews, the following broad but distinct quality dimensions were identified as critical to effective roof system installation:

- Material selection: The identification and selection of roofing materials for a specific application.

- Industry standards: The development of industrywide standards to promote uniformity in products and processes.

- Installation training: Training provided to roofing crews to develop expertise and consistency in roof system application.

- Roof system monitoring: The observation of a roof system during installation to ensure conformity with design standards.

- Roof system inspection: The observation of a roof system after installation to ensure conformity with design standards.

One quality dimension was modified for this study. The experts originally categorized "material selection" as part of a larger category of "roof system design," but several experts were concerned the concept of "design" could be considered a professional activity conducted only by licensed architects or engineers. To address this concern and avoid potential confusion among respondents, the quality dimension was limited to "material selection."

Key roofing stakeholders

For the study's purposes, a stakeholder was defined as an easily identifiable group sharing a common, frequent role in the roofing process.

Using this definition, the same experts identified the following key categories of roofing stakeholders:

- Building owners and facility managers: A building owner or building owner representative involved in the management and procurement of roofing assets.

- Roofing contracting companies: Businesses engaged in the installation of commercial roof systems.

- Roofing manufacturers: Businesses engaged in manufacturing and marketing commercial roofing materials.

- Roof consultants: Individuals or organizations hired by building owners to assess, specify and monitor roofing assets.

In addition to these primary categories, several other groups were identified but not included in the study.

For example, general contractors and construction managers frequently are involved with the roofing process, especially in new construction. However, because almost three-fourths of all commercial roofing work involves reroofing activity, I do not believe general contractors significantly affect this large segment.

In a similar manner, architects and engineers frequently are involved with specifying roof systems, but many design professionals specializing in roofing also identify themselves as roof consultants.

The survey

Based on the initial telephone survey, I developed the 2001 Roofing Quality Survey form. Survey forms were mailed to different sample groups of the various stakeholders. The contractor sample consisted of 162 NRCA contractor member executives; the consultant form was sent to 99 members of the Roof Consultants Institute (RCI); the manufacturer sample consisted of 26 executives or managers of roofing materials manufacturers; and the building owner sample consisted of 118 facility managers drawn from the database of a large manufacturer.

Surveys were returned anonymously to an independent fulfillment service. Overall, the return rate was 36.5 percent, which is high for mailed surveys.

The form required each respondent to assign ratings on a seven-point scale. First, each respondent was asked to identify the importance of each of the five key quality factors with 1 being the least important and 7 being the most important. Next, each respondent was asked to rate each of the four stakeholder groups according to its relative responsibility for each quality factor with 1 being the least responsible and 7 being the most responsible. Finally, each respondent was asked to rate each of the four stakeholder groups' relative performance for each quality factor with 1 being the worst performance and 7 being the best performance.

Because membership in industry trade associations is high for those in the commercial roofing sector, the contractor, consultant and manufacturer samples could be considered fairly representative of the industry.

In the case of the building owner sample, however, the respondents to the survey might be much less representative of their respective group. Because the building owners selected were derived from a managed list of professional facility managers, it is likely they are much more knowledgeable about roofing technology and more involved in the roofing process than average building owners or facility managers. Although the chosen selection makes it difficult to generalize the survey's findings, it allows an opportunity to look at how quality is viewed by the most professional, involved owners.

Quality factors

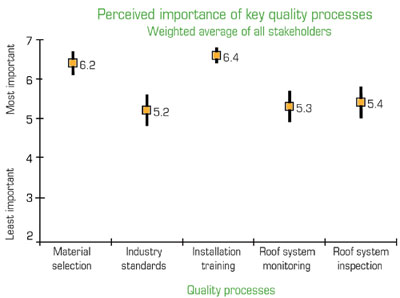

As shown in Figure 1, the combined stakeholder groups rated material selection and training significantly more important than the other three key quality factors at a 90 percent confidence level. The remaining factors—industry standards, roof system monitoring and roof system inspection—were considered equal in importance but less important than material selection and training.

Figure 1: How the industry, in general, views the importance of quality processes

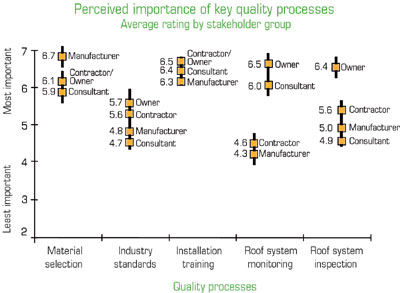

Although all stakeholder groups appear to hold similar attitudes regarding many key quality factors, some groups hold distinctly different opinions about roof system monitoring and roof system inspection. Figure 2 shows that though contractors and manufacturers consider roof system monitoring to be moderately important, building owners and roof consultants consider it to be as important as training and material selection. Similarly, though contractors, consultants and manufacturers agree roof system inspection was lower in importance, building owners consider roof system inspection to be as important as the highest-rated quality factors.

Figure 2: How industry stakeholders view quality processes

Because each stakeholder group was predefined, it is important to discern whether these nominally uniform groups actually share their opinions uniformly. Using the statistical technique of cluster analysis, two distinct subgroups were identified in the consultant and contractor samples. The groups were labeled "stereotypical" and "nonstereotypical" based on the profiles of their survey responses.

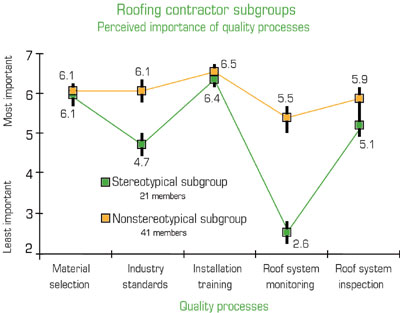

For example, a common stereotype in the roofing industry is that roof consultants frequently are perceived to be opposed to roof system inspections as an effective approach to quality assurance. Similarly, roofing contractors frequently are considered to be opposed to independent roof system monitoring. Although the overall survey results do not support these stereotypes, the cluster analysis reveals sizeable subgroups among roofing contractors and roof consultants who clearly hold stereotypical views.

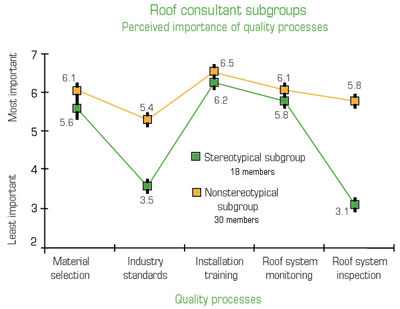

Although the nonstereotypical subgroup of roof consultants regards roof system inspection to be fairly important (5.8 points), the stereotypical subgroup assigns an extremely low rating (3.1) for this factor.

And the nonstereotypical subgroup of roofing contractors regards roof system monitoring to be fairly important (5.5 points) though the stereotypical subgroup assigns an extremely low rating (2.6) for monitoring.

Figure 3: Stereotypical and nonstereotypical roofing contractors have different opinions about quality.

As shown in Figures 3 and 4, the stereotypical roof consultants and roofing contractors also share one common attitude—a low perception of the value of industry standards.

Figure 4: Stereotypical and nonstereotypical roof consultants view some quality issues differently.

Unlike their stereotypical counterparts, nonstereotypical subgroups of roof consultants and roofing contractors appear to share a fairly balanced view regarding the importance of key quality factors. In fact, for both subgroups, there is no statistically significant difference in their ratings for any of the key quality factors.

The nonstereotypical subgroups of roof consultants and roofing contractors also share one other common attribute: Both represent the majority for their respective stakeholder groups with nonstereotypical consultants accounting for 30 of the 48 consultant respondents and nonstereotypical contractors accounting for 41 of the 62 contractor respondents.

Contributions to quality

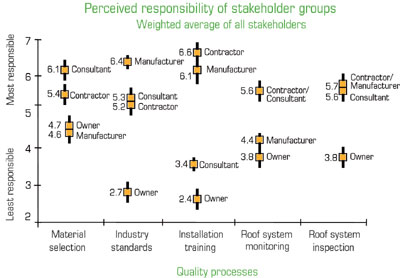

Using a weighted average for all stakeholder groups, an overall responsibility rating by key quality factor was obtained for each group.

For instance, consultants were considered to be the most responsible for material selection, and roofing manufacturers were perceived to be the most responsible for industry standards (see Figure 5). Installation training was considered to be the joint responsibility of roofing contractors and roofing manufacturers, but roof system monitoring was considered to be the joint responsibility of consultants and contractors. In the case of roof system inspection, responsibility equally was divided among consultants, contractors and manufacturers.

Figure 5: Industry stakeholders hold certain stakeholders responsible for different quality processes.

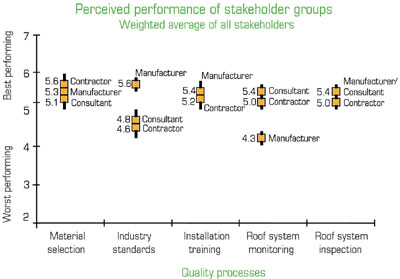

The stakeholder ratings for overall performance are fairly uniform but show room for improvement. Given the seven-point scale used in this study, an excellent performance assessment typically would require a score of 6 or more. As shown in Figure 6, however, the average weighted performance rating for almost every stakeholder group runs in a range of 5 to 5.6. Although these averages do not indicate any serious problem in stakeholder performance, they indicate room for ongoing improvement.

Figure 6: Industry stakeholders' performance ratings show room for improvement.

In surveys of perceived performance, it is not unusual for respondents' self-ratings to be significantly higher than the ratings of others. Using a weighted score of responsibility multiplied by performance, the self-perceptions of each stakeholder group were compared with those of all other stakeholders. With few exceptions, roofing contractors and roof consultants appear to significantly overestimate their respective contributions to industry quality in terms of their responsibility and performance.

Although inflated self-evaluation is a frequent, all-too-human tendency, building owners actually support the high contractor and consultant self-assessment found in the survey.

When comparing roof consultant self-ratings with owner ratings for consultants, the building owner assessment is virtually identical to the consultant self-rating.

When comparing contractor self-ratings with owner ratings for contractors, the building owner assessment tends to be higher than the contractor self-rating. This is especially revealing because the owners surveyed were among the most professional within the overall building owner population.

The stereotypical subgroups of roof consultants and roofing contractors appear to follow a similar pattern in their assessment of other groups.

In a comparison of the responses of stereotypical and nonstereotypical roof consultant subgroups, the stereotypical consultants assign significantly lower performance ratings to roofing contractors and manufacturers, especially in the areas of material selection and roof system inspection.

Similarly, stereotypical contractors perceive their performances in roof system monitoring to be significantly better than roof consultants, and nonstereotypical contractors see little difference in their roof system monitoring abilities compared with consultants.

Consensus, conflict and hope

One of the most encouraging findings in the survey is the near unanimous agreement regarding the importance of training as a means of improving quality. At a time when interest in industry training seems to be waning (witness the challenges faced by the Roofing Industry Educational Institute in recent years), the presence of a widely shared attitude regarding the importance of training may provide needed impetus for future training initiatives.

Perhaps when the construction economy starts to improve from the recent 2001-02 downturn, the existing consensus regarding training can be tapped through new industry programs and initiatives.

Although all industry stakeholders recognize the importance of training, roof system monitoring and inspection remain subjects of considerable debate. Given the survey's uncertainty regarding who should be responsible for roof system monitoring and inspection, as well as strong differences in performance ratings among stakeholders, it is clear little consensus exists regarding how the industry should address quality control in the field. Without such consensus, roof system monitoring and inspection will remain contentious and likely fuel ongoing conflicts among industry participants.

A considerable body of social research suggests the best way to reduce conflict among stakeholder groups is to engage the groups in the pursuit of a common goal. The recently announced joint program between NRCA and RCI (see "NRCA and RCI form joint task force," November 2002 issue, page 3) to develop uniform project submittal documents is a good example of how those in the roofing industry can overcome differences in attitude and opinion and work together to improve quality.

As the program develops, NRCA and RCI should consider a similar initiative to develop a uniform approach to roof system inspection and monitoring.

The identification of differing subgroups among roof consultants and roofing contractors offers hope and concern.

On the positive side, a majority of consultants and contractors surveyed do not subscribe to common industry stereotypes and appear to have a balanced view of roof system quality. Given such an outlook, it is likely a majority of contractors and consultants are well-prepared to cooperate in industrywide efforts to improve quality.

However, the attitudes of the minority stereotypical subgroups raise concern. Not only do many of the attitudes of these subgroups follow the traditional stereotype of mutual distrust, they also appear to support this stereotype in the extreme. Just as new cooperation levels may be possible among nonstereotypical contractors and consultants, new levels of conflict also are possible if the more extreme elements of each stakeholder group dominate opinion and agenda setting in the industry.

Given the reality of extreme opinion holders in the industry, it will be important to establish procedures and practices that ensure an industry group does not wield excessive control over future industry initiatives.

NRCA's recent proposal for industrywide performance standards (see "NRCA's performance standards initiative," September 2002, page 80) is a good example of a balanced approach to ensure broad participation.

By developing a charter for an industry standards process that includes representatives of all major industry groups, NRCA has charted a path that will improve roof system quality and communications among stakeholder groups. Such a broad-based approach stands as a refreshing contrast to a number of past research and standards initiatives driven only by a single stakeholder group.

As previously mentioned, the building owners and facility managers surveyed in this study are not representative of all building owners because they were selected from a professional population charged with the full-time management of building assets.

However, for this very reason, these professional building owners and facility managers can provide useful insights into potential best practices for roof system quality.

Throughout the survey, building owners gave high performance ratings to all other stakeholders. Obviously, these ratings were based on their past experiences. If we assume the professional building owners and facility managers surveyed naturally would hire similarly professional consultants, contractors and manufacturers, it is logical for the performance assessments to be high.

In addition to their apparent satisfaction with the contractors, consultants and manufacturers they employ, building owners and facility managers do not appear to perceive any inevitable conflicts in the roofing process.

Because building owners and facility managers appear to value all dimensions of roofing quality—thoughtful selection of materials, thorough worker training, responsible monitoring during installation and professional inspection upon project completion—they also tend to envision an important role for all stakeholders in the roofing process. This may indicate the building owners and facility managers surveyed have discovered effective approaches to conflict resolution and consensus building that could benefit the entire industry.

Given the level of support and enthusiasm shown by the building owners in this survey, the industry would be well-advised to include representatives from this important stakeholder group in future industry quality initiatives.

James L. Hoff is vice president of marketing for Firestone Building Products Co., Carmel, Ind.