The 2006 election results confirmed pre-election speculation that a national sense of disappointment with Republicans, referred to as a political "wave," would remove GOP officeholders on Capitol Hill in competitive "swing" districts. Compounding this were races in districts that normally vote heavily Republican but where GOP incumbents were so flawed ethically that neither they nor replacements on the ballot could hold the seats.

Other Republicans who lost were public servants with high ethical standards who simply were dragged down by the political undertow. For example, former Ohio Sen. Mike DeWine (R) had the misfortune of running in a state where the GOP governor had been convicted of wrongdoing. And in Missouri, former Sen. James Talent (R) ran a good campaign that was affected by controversial state ballot initiatives. NRCA's political action committee, ROOFPAC, supported DeWine and Talent, as well as former Sen. George Allen (R-Va.) who had an error-plagued campaign that led to his defeat.

Overall, Republicans lost 29 House seats and six Senate seats. This is in line with the post-World War II precedent where the average loss for members of the president's party in the sixth year of his term was 32 House seats and six Senate seats. The net result is that for the first time since 1994, Democrats control the legislative branch, and NRCA must consider the new political paradigm and its effect on roofing issues.

SBHPs

As the saying goes, "When one door closes, another one opens," and this may be true of the election's effect on NRCA's Capitol Hill agenda. Perhaps the biggest doors to close for NRCA are small-business health plans (SBHPs), drilling for oil in Alaska's Arctic National Wildlife Refuge (ANWR) and repeal of the estate, or "death," tax.

NRCA and more than 100 other associations in the Coalition for Small Business Health Plans lobbied Congress for a decade to allow bona fide associations such as NRCA to sell a standard menu of quality, affordable health benefits to members across state lines. The House passed such legislation no fewer than eight times, and President Bush called upon Congress to send it to him in his State of the Union speeches. But the Senate always was the problem, and though Senate Republicans finally united to create SBHPs in May 2006, their efforts were too little, too late. The Senate's Democrat leadership stopped the bill from coming to a vote.

The only chance SBHPs could be enacted during the 110th Congress is the White House's willingness to demand SBHPs be attached to Democrat-led bills, such as raising the federal minimum wage. If Democrats refuse, the White House must be prepared to use its veto power and have it sustained in Congress. A permanent lowering of the estate tax is another issue the White House could bargain for in this manner.

Tax gap

The new chairman of the House Committee on Ways and Means, Rep. Charles Rangel (D-N.Y.), has been opposed to all of the Bush administration's tax cuts. But most do not expire until the end of 2010, and legislation to extend them will be the focus of negotiations between Democrats and the White House.

Furthermore, tax policy debate will be affected by a 2006 Treasury Department report sent to Congress estimating an annual $345 billion gap between the revenue the Treasury Department should be receiving and amount it actually receives. It is believed this inspired the 3 percent withholding requirement on government contractors that was inserted with no warning by the then Republican-led Senate Finance Committee in the Tax Increase Prevention and Reconciliation Act of 2005 (P.L. 109-222).

This new Section 511 of the Internal Revenue Code mandates that federal, state and local governments withhold 3 percent from payments to contractors for goods and services beginning in 2011. Because of the section's disproportionate effect on the construction industry, NRCA is leading a coalition to repeal it. However, though the push for repeal is nonpartisan and supported by states and localities, it will be difficult to achieve because of Democrats' adherence to pay-as-you-go ("Pay-Go") budget rules. (Pay-Go means lawmakers must find offsetting revenue increases when reducing taxes.)

Alternative minimum tax

Democrat leaders plan to make reform of the alternative minimum tax (AMT) a priority in the next budget. Both Rangel and Sen. Max Baucus (D-Mont.), chairman of the Senate Finance Committee, put it at the top of their agendas.

First enacted in 1969—largely as an add-on tax—the AMT was intended to ensure a small group of high-income individuals (155!) who used deductions, credits and shelters to avoid paying federal income taxes would pay at least some tax. But the AMT, with 26 percent and 28 percent brackets and virtually no deductions, now is expected to extend its reach to 30 million taxpayers by 2010. The reason the AMT grows more rapidly over time than regular income tax is that regular income tax generally is indexed for inflation but the AMT is not.

The answer to the problem seems simple—Congress should roll back the AMT to again apply only to the extremely wealthy. However, Pay-Go will limit the extent to which this can be done because the Joint Committee on Taxation estimates the cost to the treasury of rolling back the AMT to be about $1 trillion during 10 years. Democrats will be forced to raise taxes elsewhere, making repeal of Section 511's withholding requirement on contractors a tough sell in the 110th Congress. Other potential targets for additional revenue affecting NRCA members could include S corporations and the last-in, first-out (LIFO) inventory method.

Clearly, many NRCA members and their employees would benefit from AMT reform, but NRCA's Washington, D.C., office will be vigilant to ensure the formula by which this is accomplished does not harm other roofing industry activities. To leverage the roofing industry's clout on tax issues, NRCA belongs to the S-Corporation Association, LIFO Coalition and Tax Relief Coalition.

If House Democrats opt for tax formulas heavily weighted against business, the coalitions to which NRCA belongs will support Senate filibusters to prevent such proposals from moving forward. However, budget rules often can preclude filibusters, in which case the last line of defense will be President Bush's veto pen.

Energy legislation

Democrats may look to rescind an array of industry-specific tax breaks for oil companies to help pay for at least a one-year rollback of the AMT that would cost the treasury $45 billion. Democrats also may look to disallow the LIFO inventory method for oil companies, which is of concern to NRCA and the LIFO Coalition because of proposals in the previous Congress to repeal LIFO for all taxpayers.

Perhaps the best source for tax revenue available to Democrats, with possibly the greatest economic and national security benefits for the U.S., would be to open ANWR to oil exploration. If former President Clinton had not vetoed this proposal during his administration, ANWR would be producing millions of barrels of oil. And if a handful of House Republicans had not stopped the proposal in the previous Congress, exploration would have started by now. But because most Democrats oppose drilling in ANWR, this proposal isn't going anywhere until the U.S. elects the next administration and Congress in 2008 or has its next energy crisis.

Democrats will emphasize renewable energy, energy efficiency, biofuels and conservation, and the chairman of the House Energy and Commerce Committee, Rep. John Dingell (D-Mich.), supports conservation in buildings. The Realistic Roofing Tax Treatment Act's (R2T2's) energy efficiency benefit fits this agenda, but its score from the Joint Committee on Taxation of $2 billion during 10 years is a hindrance. However, the Joint Committee on Taxation's calculations included residential rental property, which was not intended; a rescore without it should result in a much lower cost to the treasury.

Also, the chairman of the Senate Energy and Natural Resources Committee, Sen. Jeff Bingaman (D-N.M.), supports extending the energy-efficient commercial building tax deduction that expires this year. Currently, a $1.80 deduction per square foot is available for buildings that attain a 50 percent improvement over ASHRAE 90.1, "Energy Standard for Buildings Except Low-Rise Residential Buildings." NRCA will push to make the deduction more practicable and applicable to roofing.

Immigration reform

The biggest door the election opened is comprehensive immigration reform, giving the Essential Worker Immigration Coalition, to which NRCA belongs, better prospects in the House for reform along the lines of President Bush's proposal. The election proved the one-dimensional hard-line approach to immigration espoused by House Republicans did not work, with almost one-third of the 31 Democrat House pickups coming from Rep. Tom Tancredo's (R-Colo.) anti-immigration caucus.

The Senate again will pass comprehensive reform, and though House Democrats are not unified on the issue, their House majority can be expected to work with the Senate to secure the borders, create a guest worker program and establish procedures for illegal immigrants to become documented. Although the election provided a better opportunity to resolve this issue, it will not be easy.

Organized labor typically opposes guest worker programs, and a Senate bill in the previous Congress, S 2611, had troublesome language tucked in just before its floor vote to expand Davis-Bacon prevailing wages to private-sector work. Still, stakeholders know this Congress presents a rare, two-year opening to find a workable solution, and it could be a catalyst to achieving this crucial work force goal.

Rising to the challenge

This is not the first time NRCA simultaneously has advanced its agenda and protected its interests in a divided government. The last time this happened was when former President Clinton was in office and Republicans captured Congress in 1994. NRCA navigated through with minimal harm to its members and several notable legislative and regulatory achievements. The new 110th Congress will present challenges and opportunities for the roofing industry agenda, and NRCA will act accordingly.

Craig S. Brightup is NRCA's vice president of government relations.

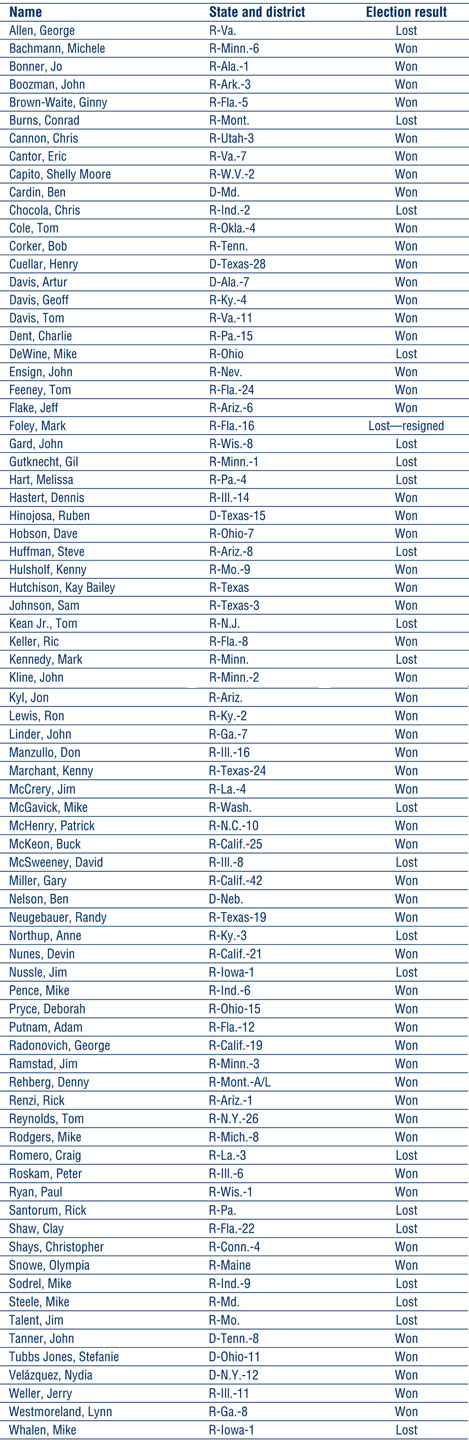

ROOFPAC election results

ROOFPAC, NRCA's political action committee, was involved in 80 House and Senate races where the candidate was on the ballot for 2006 and had a 73 percent win record. For more information about ROOFPAC, see "ROOFPAC scorecard for 2006," page 20. The list of ROOFPAC-supported candidates and the election outcome for 2006 follows.