When a prospective employee considers joining your company, he or she likely will weigh many factors: salary, vacation and sick leave policies, and health care. And though health care can be an expensive benefit to provide, it often is a deciding factor for prospective employees.

According to a 2018 survey conducted by Luntz Global Partners for America’s Health Insurance Plans, a trade association for health insurers, 46% of respondents said health insurance was either the deciding factor or positive influence in choosing their current jobs, and 56% of U.S. adults with employer-sponsored health benefits said health coverage is a key factor in deciding to stay with their current jobs.

Although salary always will be a key driver when recruiting talent, health and medical benefits can be just as important to job applicants.

Benefits are key

Benefit packages play a big role in employee recruitment and long-term retention. An Aflac® Workforces Report conducted in 2016 reveals 60% of respondents would take a job with lower pay but better benefits.

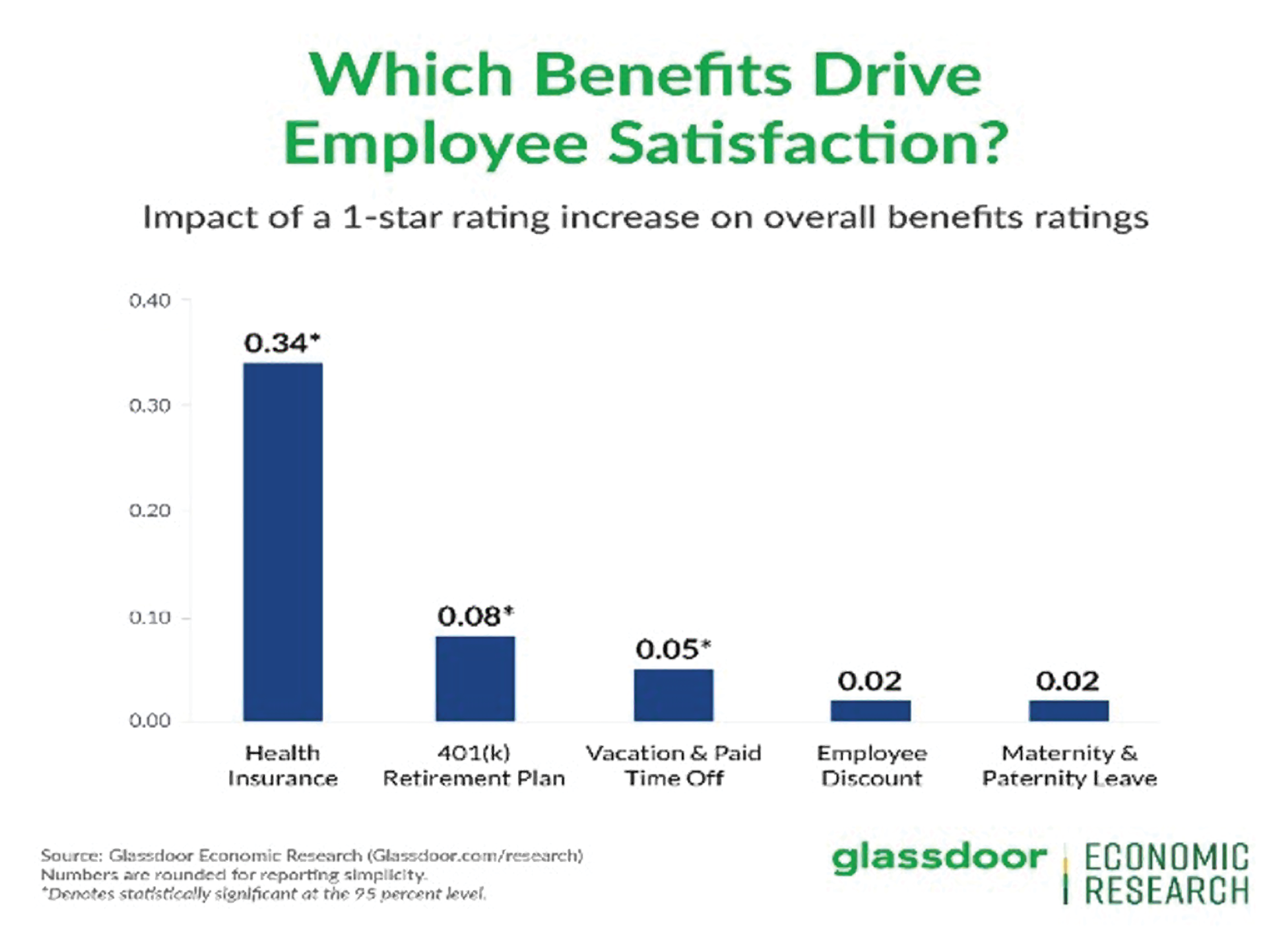

Glassdoor Inc. also has done research regarding employee benefits. The company’s 2016 article, “Which benefits drive employee satisfaction?” published on glassdoor.com, states: “Gone are the days when salaries were the focus of the total compensation puzzle. Instead, workers today want benefits—workplace health and wellness programs ... .”

Benefits ranked by employee satisfaction

Benefits ranked by employee satisfaction

According to Glassdoor’s Q3 2015 Employment Confidence Survey, more women (82%) than men (76%) prefer benefits or perks to a pay raise. And younger employees aged 18-34 (89%) and 35-44 (84%) prefer benefits or perks to pay raises when compared with those aged 45-54 (70%) and 55-64 (66%). Another Glassdoor survey revealed of 15 employee-benefit options, health insurance far surpasses a 401(k) retirement plan, vacation and paid time off, employee discount programs and maternity/paternity leave as having the greatest effect on employee satisfaction.

A new option

For a number of years, NRCA, through its Insurance Board of Governors, has been working diligently to offer health insurance programs for members, and many members have taken advantage of these offerings. However, with constantly changing federal and state health insurance regulations and laws, it has been difficult not only to offer a national program but also one that provides desired coverage options, stays viable with changing laws, and is affordable for members and employees.

After much work, NRCA is pleased to announce it has partnered with Vault Health Strategies, Bloomington, Ill., to offer a new, comprehensive national health care program that can meet each member’s unique needs and offers multiple coverages and options.

When creating the new health care program, NRCA had two primary goals: create a comprehensive health care program that addresses members’ individual needs and help members gain control over their health care costs and employee-benefit programs. In addition, the program must be competitive and provide ways for members to save money on their health care expenses.

The NRCA Health Care Program is available to all NRCA members and offers:

- Nine guaranteed-issue health care plans for small, price-sensitive companies and those with a high percentage of part-time and/or seasonal employees

- Twenty-four level-funded health plan designs for small-sized companies with two to 75 employees

- Custom-designed traditional self-funded plans for companies with 50 or more employees

- Ancillary and specialty products such as self-funded dental coverage; post-retirement benefits; life, accident and disability coverages; and hospital benefit plans

- Captive services for major medical and workers’ compensation coverages

- Risk management plans and cost strategies, including:

- A second-opinion program

- Prescription cost-containment program(s)

- Opiate dependency case management

- Telemedicine

Members can retain their current broker or use an NRCA Health Care Program broker if needed. Either way, Vault Health Strategies will be happy to provide free consultation to improve members’ existing health care plans or set up new ones.

A benefit for all

Finding and keeping good employees is one of the toughest challenges for any employer, especially in the roofing industry. The pay you offer isn’t the only motivator for attracting and retaining your workforce, so you should consider reviewing how the new NRCA Health Care Program can help you save money on your current health care offerings or add health care components to your employment package that are unique to your market and company culture.

With the NRCA Health Care Program, you now have options available for your company’s size and budget to provide health insurance-related offerings that are important to your employees and their families.

For more information about the NRCA Health Care Program, visit nrcahealth.com.