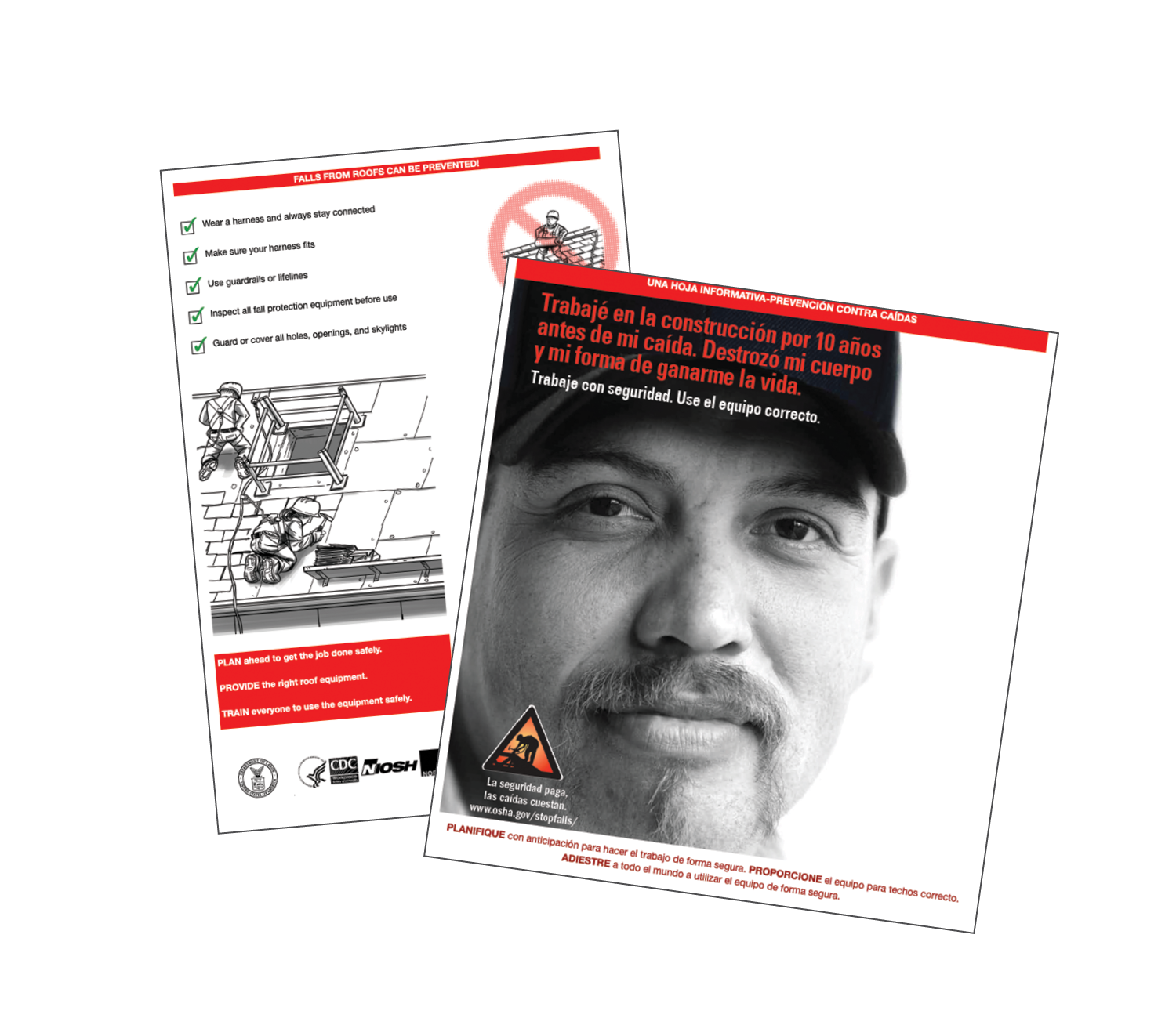

OSHA’s National Safety Stand-Down is May 4-8

|

The Occupational Safety and Health Administration’s seventh annual National Safety Stand-Down will be May 4-8 to raise awareness among employers and workers about the hazards of falls in the construction industry.

OSHA, the National Institute for Occupational Safety and Health, and the Center for Construction Research and Training are encouraging employers to pause during their workdays for topic discussions, demonstrations and training regarding how to recognize hazards and prevent falls. Afterwards, employers are encouraged to provide feedback to OSHA and will receive certificates of participation.

More than 1 million workers have participated each year during previous National Safety Stand-Downs.

Additional information is available at www.osha.gov/stopfallsstanddown/index.html.

Former NRCA vice president passes away

Piper Piper

|

Samuel T. Piper, former president of NRCA member J.A. Piper Roofing Co. Inc., Greenville, S.C., passed away Jan. 8. He was 96.

A WWII veteran, Piper served as president of J.A. Piper Roofing before his retirement in 1994; his nephew Roddy Piper currently is president of the company. Samuel Piper served as an NRCA vice president for three years, as well as an NRCA director from 1976-77, 1979-82 and 1983-86. He served as chairman of NRCA’s Manual Update Committee from 1981-82 and Awards Committee from 1983-84. He also was involved with NRCA’s Contractors Certification Task Force, Industrial Liaison Committee, Insurance Committee, Political Action Committee and Special Presidential Commission, among other committees. In addition, Piper was significantly involved with the Carolinas Roofing and Sheet Metal Contractors Association Inc. for more than 50 years, serving as a director and as president of the association.

Piper is the son of former NRCA President Joseph A. Piper, for whom the NRCA J.A. Piper Award is named. The J.A. Piper Award was established in 1947 in appreciation for Joseph A. Piper’s service to NRCA and the industry during the Great Depression. In 1983, Samuel Piper won the J.A. Piper Award, which honors a roofing professional who has demonstrated outstanding service.

Piper was the husband of the late Rachel Pride Piper. He is survived by his sons, Samuel O. Piper and wife, Betty, and Donald and girlfriend, Cathy; three stepsons, Harvey and wife, Bibi, Garner and wife, Lanae, and Charles and wife, Cathy; five grandchildren, Mark Piper and Noah, Matt, Robbie and Walker Pride; and many more family and friends. He was preceded in death by his first wife of 49 years, Mary Ellen, and three brothers, Joseph, Howard and Rodney.

Donations in Piper’s name may be made to Buncombe Street United Methodist Church, 200 Buncombe St., Greenville, SC 29601; the Citadel Foundation, 171 Moultrie St., Charleston, SC 29409; or The Salvation Army, 417 Rutherford St., Greenville, SC 29609.

Apartment building permits reach four-year high

Permits to build new apartment buildings in the U.S. are soaring as Millennials seek rental options and low interest rates alleviate construction financing costs, according to Bloomberg Law.

Authorizations for multifamily dwellings with five or more units rose to an average annualized pace of 501,000 from September 2019 through November 2019. That is the highest since July 2015—and before that year, the strongest since 1987.

A large population of Millennials is fueling the rental market, and Baby Boomers are downsizing from single-family homes. Additionally, lower interest rates are helping homebuilders meet the demand for rental properties.

“Clearly, we’re seeing some reacceleration in multifamily,” says Robert Dietz, chief economist for the National Association of Home Builders. “It’s a bit of a surprise.”

The National Multifamily Housing Council reports 76 million people in the U.S. recently have entered or will enter the housing market, mostly as renters. Multifamily housing permits are expected to elevate overall homebuilding data in 2020. However, high construction costs and the ongoing labor shortage could cause construction delays.

Tecta America marks 20th anniversary

|

Tecta America® Corp., Rosemont, Ill., is celebrating its 20th anniversary in business.

The commercial roofing corporation was created in 2000 as a consolidation of 10 roofing contracting companies that each primarily served local or regional customers. Beginning with 17 locations and 1,250 employees in 2000, Tecta America now has more than 60 locations and 2,500 employees in the U.S. Services offered to customers include roof system installation, replacement and repairs, as well as disaster response and portfolio management.

Each Tecta America company is a separate corporation owned by the national corporation, and local company leaders maintain ownership stakes. The national corporation is owned by Atlas Partners, a Toronto-based long-term investment firm. Tecta America has grown by pursuing acquisitions of independent operators who have demonstrated strong performance and management and are committed to safety.

“We’re proud of what we’ve achieved over the years, creating a nationwide company with local operations that remain solidly committed to their markets,” says Mark Santacrose, president and CEO of Tecta America. “Our approach of allowing strong local control while providing the efficiencies of combined administrative services has been the secret to our success.”

IRS releases 2020 standard mileage rates

The IRS has announced the 2020 optional standard mileage rates for calculating deductible costs associated with using an automobile for business, charitable, medical or moving purposes.

As of Jan. 1, the standard mileage rate for the use of a car, van, pickup or panel truck is 57.5 cents per mile for business miles driven. The standard mileage rate is 17 cents per mile driven for medical or moving purposes and 14 cents per mile driven in service to a charitable organization.

During 2019, the business mileage rate was 58 cents per mile and the medical and moving rate was 20 cents. The charitable rate is set by statute and remains unchanged.

It is important to note that under the Tax Cuts and Jobs Act of 2017, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, except members of the Armed Forces on active duty moving under orders to a permanent change of station.

Additional information is available at www.irs.gov/pub/irs-drop/n-20-05.pdf.

Register for the inaugural Diversity + Inclusion Forum

|

Roofing professionals are invited to register for the inaugural Diversity + Inclusion Forum 2020. Hosted by NRCA, National Women in Roofing and the California Hispanic Chambers of Commerce, the event will be held in Washington, D.C., Tuesday, April 21, preceding Roofing Day in D.C. 2020.

The forum will help attendees identify ways to engage underrepresented groups, develop resources to increase cultural competency, and explore why supporting diversity and fostering a culture of inclusion is a business imperative.

During the event, industry leaders and stakeholders will discuss sustainable strategies for advancing diversity and inclusion. Attendees will have opportunities to network with industry professionals from across the U.S. who are striving to achieve inclusive, culturally diverse and competent workforces.

The event schedule and registration information are available at nrca.net/diversity-inclusion.