We now are in President Obama's second term, and still little progress has been made on an issue clearly important to the roofing industry—immigration. Roofing workers are scarce, and without a reliable source of workers, many contractors are faced with the risk of hiring undocumented workers.

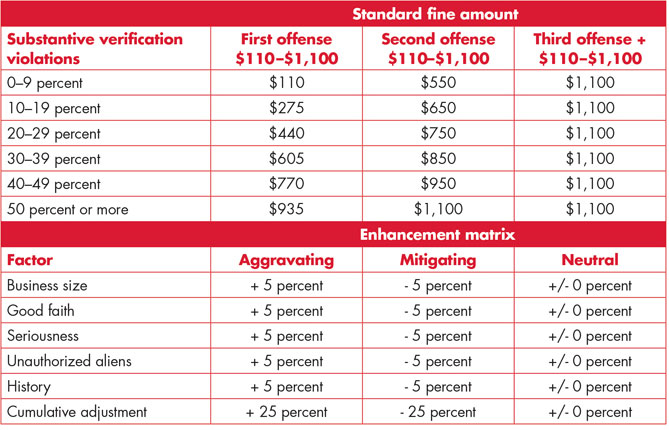

The Immigration Reform and Control Act requires employers to verify employees' identities and employment eligibility; the Employment Eligibility Verification Form I-9 is the primary means of documenting this verification. Employers who fail to properly complete I-9 forms are subject to civil fines ranging from $110 to $1,100 per paperwork error violation.

Immigrations and Customs Enforcement (ICE) is an investigative branch of the Department of Homeland Security (DHS) charged with enforcing U.S. immigration and customs laws. ICE was created in 2003, and it assumed the responsibility of enforcing the immigration laws from the Immigration and Naturalization Service, commonly known as INS.

ICE verifies employer compliance with I-9 requirements by conducting inspection audits, which are initiated by serving a Notice of Inspection to an employer compelling him or her to produce I-9 documents. I-9 audits are a critical component in ICE's work-site enforcement strategy.

ICE has revealed it is focusing its audit and inspection efforts on critical infrastructure industries and industries with work forces that traditionally depend on vulnerable workers, such as the construction industry.

The I-9 audit

As noted, an I-9 audit process begins when an employer receives a Notice of Inspection from ICE. The notice typically allows the employer three business days to present the requested I-9 forms. Often, ICE will request the employer provide supporting documentation, which may include a copy of the payroll and employee roster. This information helps ICE determine whether the employer is properly retaining I-9 forms for current and former employees. Additional business records also may be requested.

After the I-9 documents are provided to ICE agents, the agents then conduct inspections of each form to verify the employer's compliance with I-9 obligations. Once the initial review of the I-9 forms is complete, ICE will notify the audited party, in writing, of the inspection results.

If the audited employer is found to be in compliance, the notice received from ICE is referred to as a Notice of Inspection Results, or a compliance letter. If, after its review of the I-9 forms, ICE determines an employee is unauthorized to work, it advises the employer of the possible criminal and civil penalties for continuing to employ that individual. This notice is referred to as a Notice of Suspect Documents. The notice provides the employer and employee an opportunity to present additional documentation to demonstrate work authorization if they believe the finding is in error.

If ICE is unable to determine a particular employee's work eligibility, ICE provides a formal Notice of Discrepancies. A Notice of Discrepancies advises the employer to provide the employee with a copy of the notice and to give the employee an opportunity to present ICE with additional documentation to establish employment eligibility.

When technical or procedural violations are found, ICE issues a Notice of Technical or Procedural Failures. This notice gives the employer 10 business days to make corrections. If corrections are not made in a timely manner, ICE determines a substantive violation has occurred. An employer may receive a monetary fine for all substantive and uncorrected technical violations.

If a fine will be issued, ICE publishes a Notice of Intent to Fine to the employer. Penalties for substantive violations, which include failing to produce an I-9 form where retention of the form was required, range from $110 to $1,100 per violation.

Penalties

To determine penalty amounts, ICE considers five factors: the size of the business, good faith effort to comply, seriousness of violation, whether the violation involved unauthorized workers and history of previous violations. However, penalties or substantive violations are not issued in every instance. In circumstances where substantive verification violations were identified but the circumstances are such that a monetary fine is not warranted and there is an expectation of future compliance by the employer, ICE will issue a Warning Notice.

Figure 1: Standard I-9 form violation fine amounts

When a fine will be issued, the process of determining the fine amount begins with the ICE agent or auditor dividing the number of violations by the number of employees for which an I-9 form should have been prepared to obtain a violation percentage. This percentage provides a base fine amount depending on whether this is a first offense, second offense, or third or more offenses. Figure 1 sets forth the applicable base, or standard, fine amounts, which still are subject to enhancement or mitigation depending on the five factors discussed earlier. The standard fine amount listed in Figure 1 relates to each I-9 form with violations.

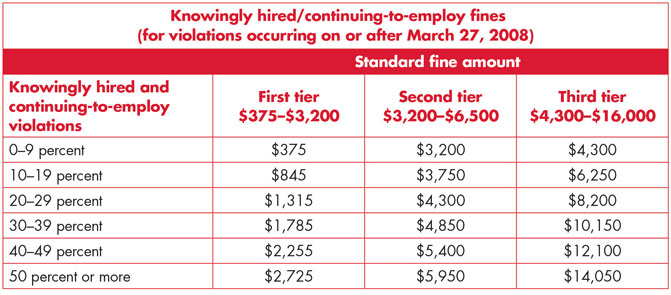

Employers determined to have knowingly hired or continued to employ unauthorized workers will be required to cease the unlawful activity, may be fined and, in certain situations, may be criminally prosecuted. Additionally, an employer found to have knowingly hired or continued to employ unauthorized workers may be prevented from participating in future federal contracts and receiving other government benefits.

Monetary penalties for knowingly hiring and continuing to employ differ from penalties for substantive and uncorrected technical violations. Penalties for knowingly hiring and continuing to employ range from $375 to $16,000 per violation with repeat offenders receiving penalties at the higher end. ICE considers the same five factors when determining penalty amounts for knowingly hiring and continuing to employ unauthorized workers as it considers for I-9 violations.

The process for determining the penalty amount begins similarly to the process for substantive and uncorrected technical violations. The ICE agent or auditor divides the number of knowingly hiring and continuing-to-employ violations by the number of employees by which an I-9 form should have been prepared to obtain a violation percentage. This percentage provides a base fine amount depending on whether this is a First Tier (first-time violator), Second Tier (second-time violator) or Third Tier (third- or subsequent-time violator) case. The standard fine amount listed in Figure 2 relates to each knowingly hiring and continuing-to-employ violation. The ranges of the three tiers of penalty amounts appear in Figure 2.

Figure 2: Standard fine amounts for knowingly hiring or continuing-to-employ violations

In instances where a Notice of Intent to Fine is served, charging documents will be provided specifying the violations the employer committed. The notice also provides the employer with an opportunity to either negotiate a settlement with ICE or request a hearing before the Office of the Chief Administrative Hearing Officer. The hearing request must be made within 30 days of receipt of the notice. If the employer takes no action after receiving the notice, ICE will issue a Final Order. If a hearing is requested, the Office of the Chief Administrative Hearing Officer assigns the case to an administrative law judge and sends all parties a copy of a Notice of Hearing and government's complaint.

The Notice of Hearing explains to the employer the procedural requirements for answering the complaint and potential consequences for failing to file a timely response. Many cases never reach the evidentiary hearing stage because the parties either reach a settlement, subject to the approval of the administrative law judge, or the judge reaches a decision based on the merits through dispositive prehearing rulings.

Preparing for the audit

If you receive a Notice of Inspection, you should conduct an internal audit of your I-9 forms and correct any mistakes before the audit. This internal audit should be conducted by a third party, and an effort should be made to avoid allowing employees to review their own work. If you conduct an I-9 audit internally, the individual reviewing the forms should be someone other than the individual completing I-9 forms on your behalf during the hiring process.

If, during the review, mistakes are found, the mistakes should be initialed and dated and never backdated.

Correcting mistakes in this manner can avoid a large fine.

In addition, make sure to keep I-9 forms separate from other employment-related documents because if ICE discovers a possible violation of the law within the Department of Labor's (DOL's) jurisdiction during an audit, ICE must contact the appropriate DOL field office.

E-Verify

Some employers believe the best preparation for an I-9 audit is to participate in E-Verify. E-Verify is an online system administered jointly by DHS, which is part of U.S. Citizenship and Immigration Services (USCIS), and the Social Security Administration (SSA) that allows employers to verify the employment eligibility of their employees regardless of citizenship.

E-Verify has been available for every U.S. business since late 2004. Participation in E-Verify generally is voluntary; however, all federal contracts with a period of performance longer than 120 days and a value more than $100,000 include a clause requiring the prime contractor to register and participate in E-Verify. For subcontracts that flow from these federal contracts, the rule extends the E-Verify requirement if the value of the subcontract exceeds $3,000.

You can register to participate in E-Verify by visiting www.uscis.gov/portal/site/uscis and selecting "E-Verify Home page." At the conclusion of the registration process, you will be asked to read and sign a Memorandum of Understanding, which is a legal document stating terms and conditions for participating in E-Verify. Among other requirements, the memorandum requires you to display notices supplied by USCIS regarding participation in E-Verify. The memorandum also requires you to provide SSA and USCIS the names, titles, addresses and telephone numbers of your company representatives to be contacted regarding E-Verify.

If you have multiple locations but hire out of one central location, you only need to register with E-Verify through the central location. During the registration process, select "multiple site registration" when prompted. The system then will ask you to identify the number of sites per state you will be verifying.

Not every site needs to be enrolled in E-Verify. You can choose which sites to enroll and can add additional sites later. But if each location does its own hiring, each location must decide whether to participate in E-Verify. Each site that decides to participate in E-Verify must go through the registration process and sign a Memorandum of Understanding.

How does it work?

Registering and participating in E-Verify does not eliminate the need for you to complete an I-9 form for each new hire. Indeed, the information provided on an I-9 form is used to verify a new hire's work authorization status through use of E-Verify. However, the Memorandum of Understanding requires two slight modifications to the I-9 process.

First, the memorandum requires you only accept a List B identity document (acceptable documents appear on the I-9 form) that contains a photograph. Second, if an employee presents a DHS Form I-551 (Permanent Resident Card) or Form I-766 (employment authorization document), you must photocopy the document and retain the photocopy with the employee's I-9 form.

Importantly, the memorandum requires you to agree not to use E-Verify procedures for pre-employment screening of job applicants. Until federal law required federal contractors and subcontractors to participate in E-Verify if their contracts meet the minimum thresholds, the memorandum was clear E-Verify was to be used only to verify the work authorization status of new hires.

Significantly, federal law requires covered contractors and subcontractors to not only verify the employment eligibility of all people hired during the term of federal contracts but also requires federal contractors and subcontractors with covered contracts to verify the employment of all people assigned to federal contracts. The memorandum reflects these requirements within a separate section titled "Responsibilities of Federal Contractors."

When you hire a new employee, federal law requires the employee to complete an I-9 form within the first three business days of hire. If you participate in E-Verify, new hires are required to provide their Social Security numbers in Section 1 of the I-9 form. If an employee does not have a Social Security number but is otherwise able to prove identity and work authorization status, you can wait to perform an E-Verify query. In this instance, note on the I-9 form why an E-Verify query has not yet been performed.

Once the I-9 form is completed, you will log on to a secure DHS website within three business days of the day of hire and enter the employee's full name, date of birth and Social Security number. A drop-down menu will appear, and you will need to choose the documents provided by the employee to establish identity and work authorization. After you submit the information, the data immediately is sent to the SSA, which has up to three federal work days to provide confirmation or tentative nonconfirmation of the individual's Social Security number.

If the Social Security number and name match SSA records, you will receive a message within two or three seconds that the employee is authorized to work and the process is complete.

If the number and name do not match SSA records, you will need to refer the employee to an SSA field office as directed by the automated system. You will receive a case verification number and will need to record it; you will need to review the input to detect any transaction errors; and you will need to determine whether the employee contests the tentative nonconfirmation.

If the Social Security number and name match but the SSA cannot verify the employee is authorized to work (the Social Security number may have been issued "not for employment purposes"), you will get a message that DHS is attempting to verify work authorization. If DHS finds a match, the E-verify system will report this to you and the process is complete. DHS has up to three federal work days to provide confirmation or tentative nonconfirmation of employment eligibility. In these instances, you are encouraged to check E-verify daily for a response.

If neither SSA nor DHS can verify an employee's work authorization status, a tentative notice of nonconfirmation is issued. You will be instructed to print the tentative notice of nonconfirmation and provide it to the employee. The employee must decide whether to contest the tentative nonconfirmation. If the employee contests it, you will provide the employee with a referral letter and instruct the employee to visit either the SSA or DHS, depending on which entity issued the tentative notice of nonconfirmation, within eight federal workdays of the date of the referral letter.

The Memorandum of Understanding requires the SSA and DHS to provide final confirmation or nonconfirmation of employment eligibility within 10 federal workdays of the date of the referral letter.

If the employee does not contest or resolve the nonconfirmation finding within eight federal workdays from the date of referral, E-Verify issues a final nonconfirmation notice and you must either immediately terminate the employee or notify DHS you are continuing to employ the person (possibly inviting an investigation and penalties).

The Memorandum of Understanding specifically provides an employer must notify DHS if he or she continues to employ any employee after receiving a final nonconfirmation notice. A failure to notify DHS will subject you to a civil money penalty between $500 and $1,000 for each failure to notify and also a rebuttable presumption that you knowingly employed an unauthorized alien.

Unless state law or federal law requires participation, you are free to terminate your participation in E-Verify at any time. Signing the Memorandum of Understanding does not commit you to participating in E-Verify for any period of time.

Expect intensity

ICE recently announced it commenced the highest number of I-9 audits during fiscal year 2012, which ended Sept. 30, 2012. ICE indicated I-9 audits of employers increased from 250 in fiscal year 2007 to more than 3,000 in fiscal year 2012. Expect this trend to continue. With an understanding of how the audit process works and how you can prepare for it, your company will be in a better position to avoid any fines or penalties at the conclusion of the audit process.

Philip J. Siegel is a partner with Atlanta-based law firm Hendrick, Phillips, Salzman & Flatt.