During conversations with hundreds of successful business owners, I have discovered some common misconceptions about exiting businesses and harvesting owners' wealth. If you do not understand the following myths and truths, you probably are putting your wealth at a high-level risk.

Myth No. 1: I will just sell my business and retire.

Truth: According to the U.S. Chamber of Commerce, fewer than 20 percent of businesses for sale actually close, and the percent of closings actually is less for the construction industry. According to Fails Management Institute, Raleigh, N.C., most transactions in the construction industry are internal; a majority of transactions are management buyouts, and a small percent includes Employee Stock Ownership Programs (ESOPs) and some form of gifting.

Myth No. 2: I will deal with my exit plan in five years.

Truth: Sometimes, when I ask a business owner when he or she intends to retire, the answer is: In five years. Three years later, the answer still is: In five years. This simply translates to the owner having no plan and not being mentally prepared for the complex process of retiring.

It is important to make time now to create an exit plan because your exit process may take five, 10 or 15 years to execute to meet your financial needs during retirement. Many of these financial instruments are paid by the company and leveraged by compounding over time. Further, it takes time and training to replace yourself during a formal succession process.

Myth No. 3: I can probably do this myself.

Truth: You know how to run your business, but have you ever exited a business? Statistically speaking, you're likely to fail. A study by Boston-based Family Firm Institute Inc. found:

This means your grandchild has about a 3 percent chance of running the business you hope to transfer to your son or daughter. Those are not good odds.

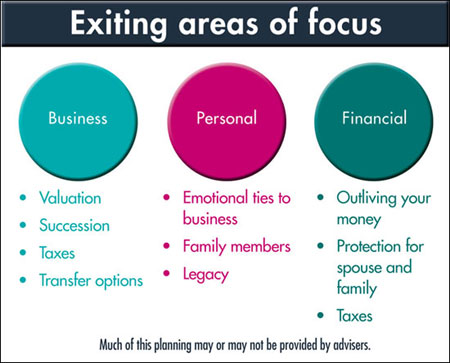

As a business owner, you have had conversations with your accountant, lawyer, insurance agent and many other professionals, and the information about your business is scattered. Creating an exit plan pulls all your personal, business and financial wealth together and unlocks the trapped business wealth in the most efficient manner.

Things to focus on when exiting a business

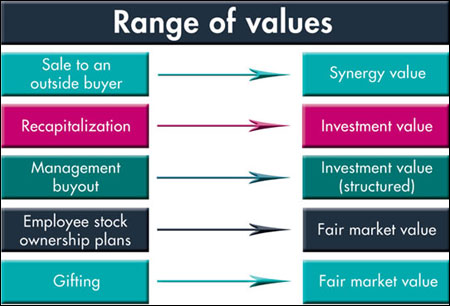

Myth No. 4: My business is worth $7 million.

Truth: The reality is your business has different values depending on who buys your business. This is called a "range of values." I recommend obtaining the services of an accountant with an advanced Certified Valuation Analyst certification because valuing a business must hold up to Internal Revenue Service standards and follow tight procedures. Most owners overvalue their businesses and have false impressions of their actual worth. And remember, taxes, fees and a poor exit plan could reduce your harvest 20 to 60 percent.

Myth No. 5: That will never happen to me.

Truth: Once per month, I receive a telephone call regarding an owner's untimely death or disability. In most cases, too many buy-sell agreements are underfunded and written in a way that will not deliver the owner's goals, resulting in unintended outcomes.

Several recent horror stories have business owners in court for many years, spending hundreds of thousands of dollars in legal fees. Two months ago, a buy-sell agreement was structured in a way that unintentionally created income tax for the widow. In another case, the widow who never worked in the business was demanding her husband's office, position and salary and was not welcomed by the surviving owner.

Myth No. 6: If I could get $4 million, I would retire tomorrow.

Truth: I know $4 million sounds like a lot, but even though you probably have more than 70 percent of your wealth trapped in your business, the real question is: How much do you need to replace your income?

You have to consider your money outside the business in your savings, retirement funds, real estate, investments, etc., and understand the tax implications of these investments. Your exit plan is coordinated according to your business, personal and financial goals and ties these areas together to reach your "value gap," or the amount you need to get out of your business to retire and replace your income.

The range of values for a business

Myth No. 7: But my accountant does exit planning.

Truth: You probably have a good accountant and a book value for your company, but a successful exit plan incorporates all areas—personal, business and financial—of your life.

My previous company's team of owners invested six years and more than $250,000 for fragmented advice as we wandered down the exit path with two offers from industry roll-ups to consolidate our space and two offers from boutique private equity firms to invest in our company. Additionally, we investigated an ESOP and a management buyout to transfer the stock of three owners to five new owners. We received advice from everyone and still were lost for many reasons.

An exit planner is trained as a process consultant to move an owner's goal to a path that meets the owner's financial target, replaces the owner and protects the wealth with a comprehensive holistic result. An exit planner juggles a business owner's goals with scattered business, personal and financial information and creates one document to guide the owner down a business exit path for a desired outcome.

Exit planning is the orchestration of many disciplines coordinated into one comprehensive report. The report defines all the options to determine the best fit for your goals and navigates a path out of the business. This combined information will give you the best overall result once the exit is complete.

After the exit plan is delivered, the next stage is a separate execution phase. An exit planner also can help you coordinate different disciplines and professional advisers, including attorneys, tax attorneys, accountants, estate planners, insurance advisers, financial planners, business consultants and others in the exit plan's production and execution.

Truth: Now, you're more prepared to create a successful exit plan.

I hope these seven myths of exit planning have provoked your thinking and helped you understand the challenges and risks of capturing your trapped business wealth. The good news is there is a systematic proven process that takes three to six months to complete to produce a successful exit plan.

Kevin Kennedy is founder and chief executive officer of Beacon Exit Planning LLC, Elmira, N.Y.