NLRB issues joint-employer final rule

On Feb. 26, the National Labor Relations Board issued a final rule regarding what makes two companies joint employers under the National Labor Relations Standards Act, according to www.constructiondive.com.

Under the act, if two companies are deemed to be joint employers, both are required to bargain with the union that represents the jointly employed employees. Both companies also are potentially liable for each other’s unfair labor practices and subject to union actions, such as picketing in the case of labor disputes.

The NLRB’s final rule states a company is considered a joint employer of another company’s employees only if the two share or co-control the employees’ “essential terms and conditions of employment,” which are defined as wages, benefits, work hours, hiring, termination, discipline, supervision and direction.

The NLRB’s supplementary information accompanying the rule said a clarification of what constitutes joint-employer status was necessary after a 2015 court decision made it possible for a company to be declared a joint employer under the act even if control over another company’s employees was limited, indirect and routine or was identified in a contract but never exercised.

The new rule does not affect how the Occupational Safety and Health Administration determines responsibility for workplace injuries when there is more than one contractor working on a project. OSHA’s multiemployer citation policy outlines how inspectors should evaluate the circumstances surrounding an accident before citations are issued to more than one employer.

Workers reporting unsafe conditions are protected

The Occupational Safety and Health Administration is reminding employers it is illegal to retaliate against workers because they report unsafe and unhealthful working conditions during the COVID-19 pandemic. Acts of retaliation can include terminations, demotions, denials of overtime or promotion, or reductions in pay or hours.

A worker has the right to file a whistleblower complaint online with OSHA or call (800) 321-OSHA if he or she believes an employer has retaliated against him or her for exercising his or her rights under the whistleblower protection laws enforced by the agency.

Additional information and resources are available on OSHA’s Whistleblower Protection Program webpage, www.whistleblowers.gov, including fact sheets about whistleblower protections for employees in various industries and frequently asked questions.

Virginia takes action to stop worker misclassification

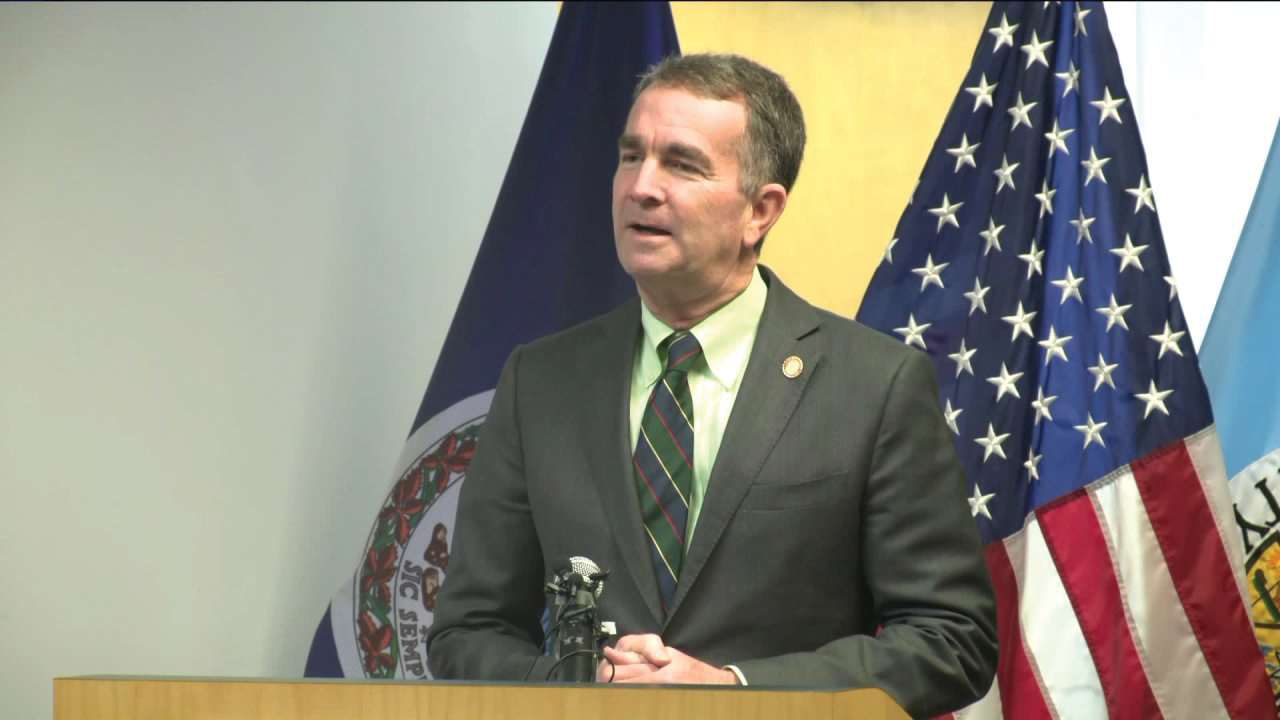

Gov. Ralph Northam (D-Va.) Gov. Ralph Northam (D-Va.)

|

On April 12, Gov. Ralph Northam (D-Va.) signed into law two bills intended to target worker misclassification in the state.

The Virginia House of Delegates approved legislation (H.B. 1407) that would allow the state Department of Taxation to investigate and impose penalties on companies that misclassify employees as independent contractors. The legislation imposes a fine of up to $1,000 per misclassified worker and higher penalties for additional violations.

Virginia delegates also passed a second bill (S.B. 662) that would punish employers that retaliate against workers who report misclassification to authorities.

The governor’s support of the bills was expected. In November 2019, Northam said Virginia lost about $28 million per year in tax revenue because employees were misclassified as contractors, who are not guaranteed minimum wages, overtime benefits or other employment protections.

Worker classification is attracting more attention from state lawmakers in part because of the rise in app-based transportation and delivery services, such as Uber and DoorDash. However, the issue also affects industries such as construction, health care and information technology. New Jersey and California recently enacted employee classification laws, and other states are considering similar measures.

IRS provides effective date for tax credits under FFCRA

In March, the IRS issued a notice providing the effective date for employment tax credits for qualified sick leave and family leave wages under the Families First Coronavirus Response Act.

IRS Notice 2020-21 provides that employment tax credits for paid qualified sick leave wages and paid qualified family leave wages required by the Families First Coronavirus Response Act will apply to such wages and compensation paid for periods beginning April 1, 2020, and ending Dec. 31, 2020.

The notice also provides that days beginning April 1, 2020, and ending Dec. 31, 2020, will be taken into account for credits for paid qualified sick leave equivalents and paid qualified family leave equivalents for certain self-employed individuals.

IRS Notice 2020-21 is available at www.irs.gov/pub/irs-drop/n-20-21.pdf.

California eases solar mandate for new homes

|

On Feb. 20, the California Energy Commission voted unanimously in favor of a measure proposed by the Sacramento Municipal Utility District to allow homes to get power from solar farms rather than rooftop panels.

The decision eases up on California’s existing mandate enacted in 2018 that requires most new homes starting in 2020 to include solar panels. Builders cautioned the mandate could increase the cost of buying a house by nearly $10,000.

The new rule includes a provision allowing utilities and others to propose programs for new homes to forgo rooftop panels and instead draw power from community solar farms, which generally are smaller installations close to the customers they serve. Sacramento Municipal Utility District’s initial proposal garnered criticism that it shouldn’t have been considered “community solar” because the power plants were too large or too far away from the houses they would power. The utility responded by proposing homes get electricity from a 13-megawatt solar plant near Sacramento scheduled to be completed in November.

“Both rooftop and community solar have benefits, but at the end of the day, they both reduce carbon,” Steven Lins, director of government affairs for the Sacramento Municipal Utility District, told the commission.

Solar advocates argue the new provision violates the intent of California’s solar rooftop mandate, which was for new homes to generate their own energy. Commissioners say the revised program could help the state find ways to slash greenhouse gas emissions from homes and multifamily buildings that may not be suited for rooftop solar arrays.

OSHA issues enforcement guidance for recording COVID-19 cases

The Occupational Safety and Health Administration has issued interim guidance for enforcing OSHA’s record-keeping requirements (29 CFR Part 1904) regarding recording cases of COVID-19, according to www.osha.gov.

Under OSHA’s record-keeping requirements, COVID-19 is a recordable illness. Employers are responsible for recording cases of COVID-19 if a case:

- Is confirmed as a COVID-19 illness

- Is work-related as defined by 29 CFR 1904.5

- Involves one or more of the general recording criteria in 29 CFR 1904.7, such as medical treatment beyond first aid or days away from work

However, in areas where there is ongoing community transmission, employers other than those in the health care industry, emergency response organizations (such as emergency medical, firefighting and law enforcement services) and correctional institutions may have difficulty determining whether workers who contracted COVID-19 did so as a result of exposures at work.

Accordingly, until further notice, OSHA will not enforce its record-keeping requirements to require employers such as roofing companies to make work-relatedness determinations for COVID-19 cases, except when there is objective evidence a COVID-19 case may be work-related and the evidence was reasonably available to the employer. Employers of workers in the health care industry, emergency response organizations and correctional institutions must continue to make work-relatedness determinations pursuant to 29 CFR Part 1904.

OSHA’s enforcement policy is meant to provide certainty to the regulated community and help employers focus their response efforts on implementing good hygiene practices in their workplaces and otherwise mitigating COVID-19’s effects.

This action from OSHA is in direct response to a letter from the Construction Industry Safety Coalition, of which NRCA is a part.